Phil Strano, Portfolio Manager of the Yarra Absolute Credit Strategy, provides an update on why he’s comfortable with his fund’s exposure to Australia’s Major Banks.

While it’s fair to say that 2019 was a forgettable year for Australia’s Major Banks, investors holding their debt had a much better time of it. Amidst the chase for yield, credit margins across Senior (-40 bps), Tier 2 (-40 bps) and Tier 1 (-70 bps) securities all contracted significantly, underpinning impressive capital returns.

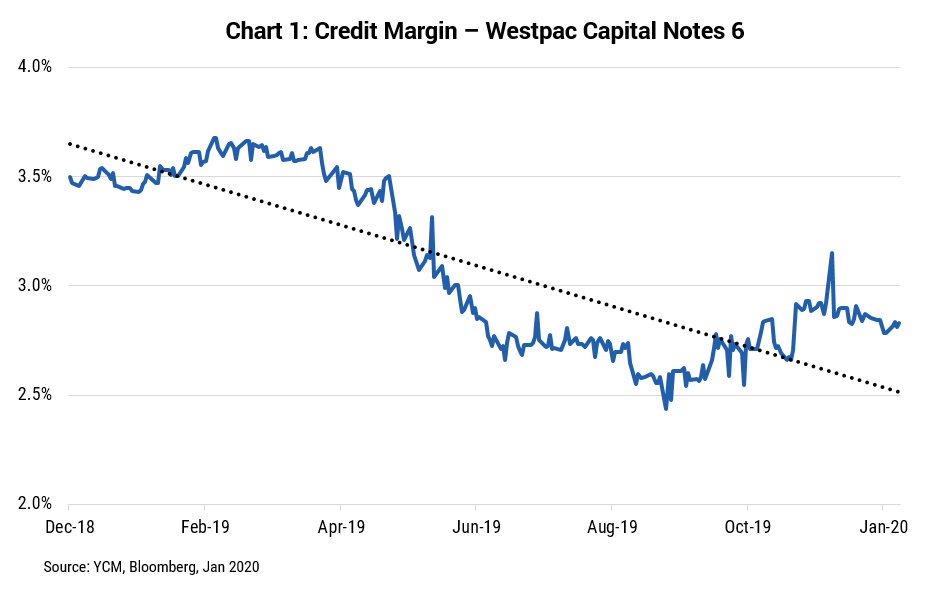

One example which was common across the major banks was WBC’s Tier 1 securities, with credit spreads on these securities contracting from a high of ~360 bps in Feb-2019 to ~280 bps at the close of 2019 (refer Chart 1), equating to a ~8.3% total return (incl. franking).

As we begin 2020, debt investors are rightfully asking whether bank securities still offer compelling value. While not as attractive in absolute terms compared to the beginning of 2019, in our view there are reasons for continued optimism and scope for further outperformance. Here’s why.

1. Fundamentals suggest sustained higher risk-adjusted returns

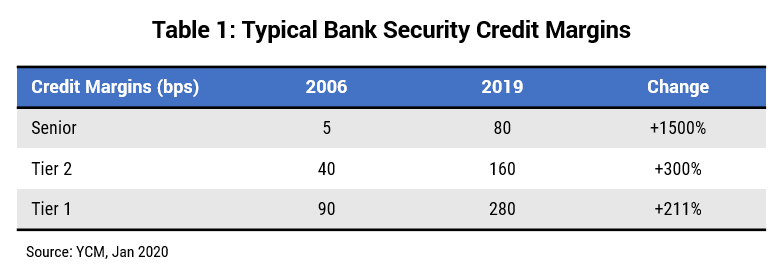

Bank credit margins remain much higher today than their pre-GFC lows (refer Table 1). This is despite meaningful regulatory reform which has increased equity funding (incl. retained earnings) and driven an exodus in risk weighted assets.

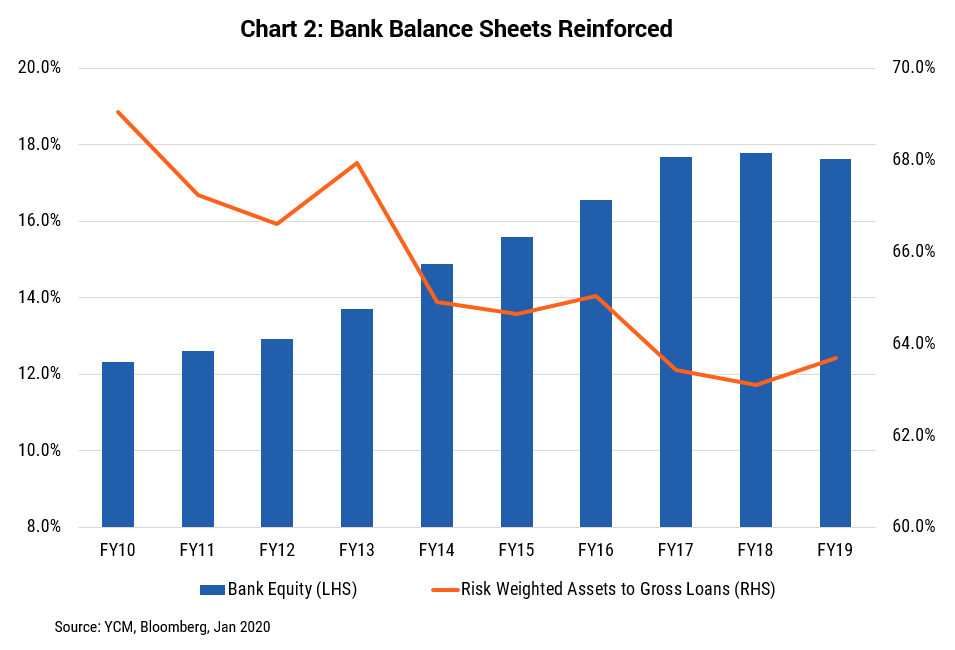

Overall, increasing bank equity (including retained earnings) by one-third has added a significant cushion, meaning future bad debts can be absorbed without impacting credit quality. Having both proportionally higher equity funding and a lower weighting to riskier assets (refer Chart 2), in our view, underpins higher risk-adjusted returns and underwrites the performance of major bank credit for the foreseeable future.

2. Market technicals and relative value remain supportive

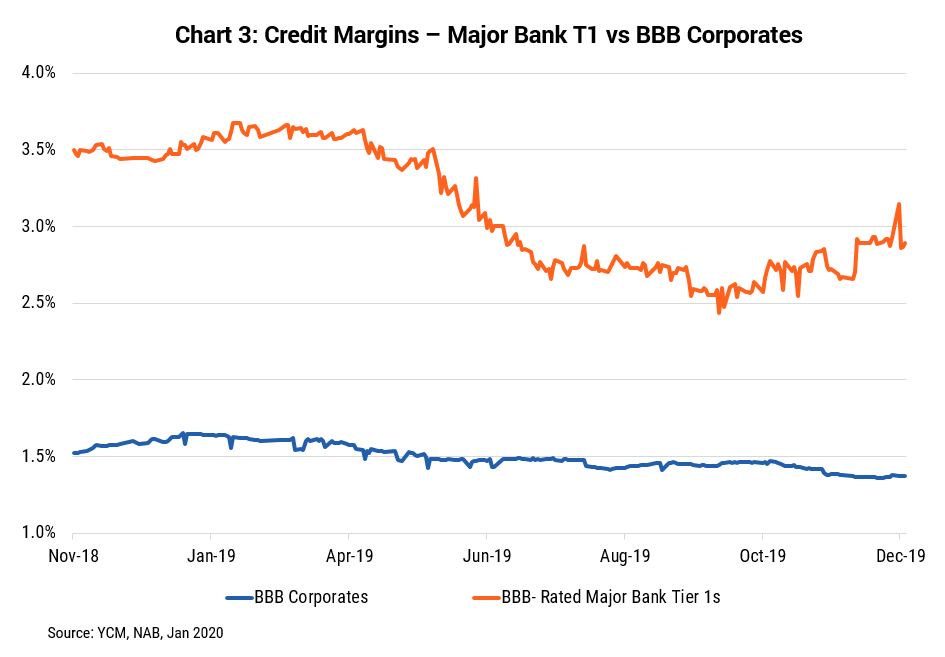

While bank spreads are lower than this time last year, we believe that relative to other comparable credit investments, major bank paper still offers higher risk-adjusted returns. Credit margins for BBB- rated major bank Tier 1 securities, for example, are roughly double those of similar rated corporates (refer Chart 3). While Tier 1 securities are exposed to extension/conversion risk – outcomes we consider highly unlikely – investors are being more than adequately compensated for that perceived optionality.

We continue to find compelling opportunities across the bank capital structure, with AA- rated Senior (~80bps), BBB+ rated Tier 2 (~160bps) and BBB- rated Tier 1 securities (~280bps) all offering attractive risk adjusted returns. We see scope for Tier 2 to outperform both Senior and Tier 1 and continue to favour the old style Basel 2 NABHA and MBLHB Tier 1 securities, with both securities likely to be subject to early redemption in the next 18-24 months.

0 Comments