Phil Strano, Portfolio Manager of the Yarra Higher Income Fund, looks at why he’s favouring T2 securities in the current market environment.

We are certainly experiencing a volatile period in markets, with higher inflation, increasing interest rates in the coming months/year and a continuation of pandemic/war supply disruptions.

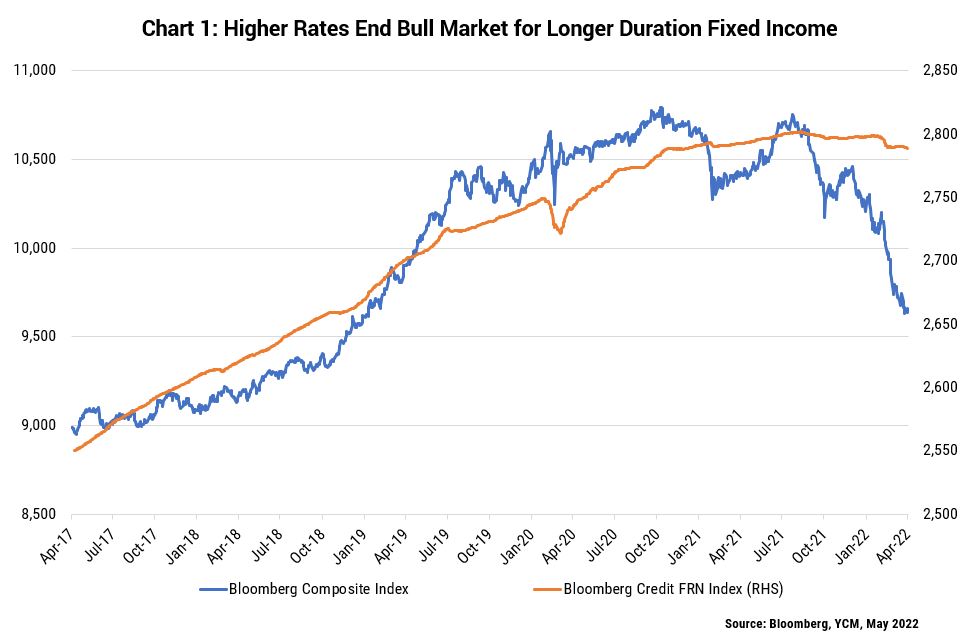

Through the back half of 2020 and into 2021 we were wary of the re-emergence of higher rates and the vulnerability of longer interest rate duration assets such as traditional fixed income. While not surprised by the sell-off in duration, its magnitude has surprised, with the total return from the Bloomberg Composite Index down ~8% year-on-year.

By contrast, total return from the Bloomberg Credit FRN Index which is of inferior credit quality but with much shorter interest rate duration is down just 0.16% in the same time frame (refer Chart 1).

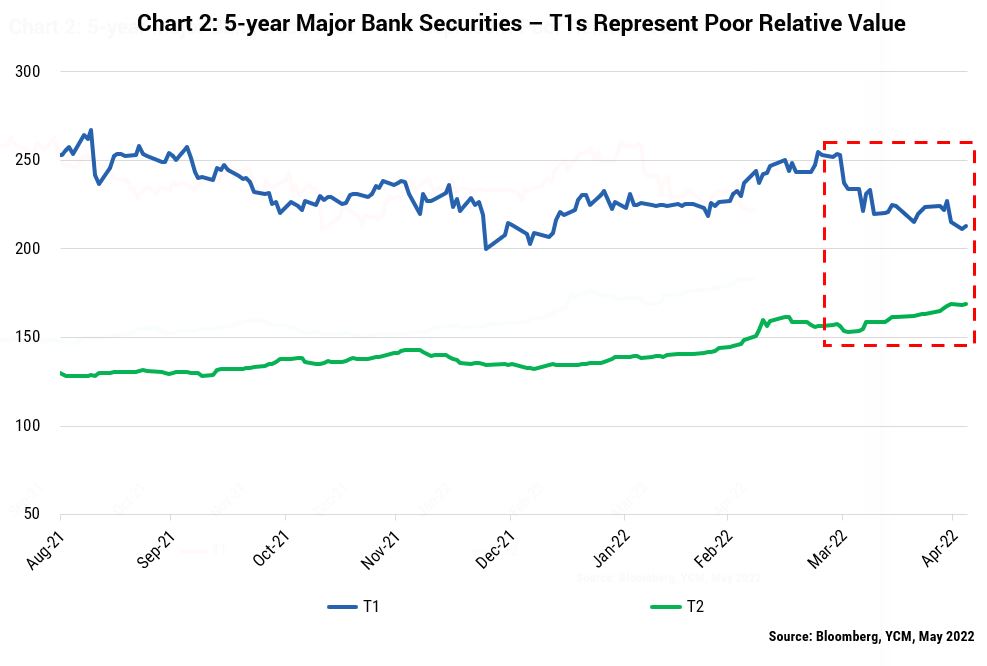

Meanwhile, emergent pricing differentials in ASX and OTC markets for floating rate major bank debt securities points to some mispricing of shorter duration assets. Since the beginning of 2022, BBB- rated ASX listed Tier 1 (T1) major bank securities have significantly outperformed much higher quality major bank AA- rated Senior and BBB+ rated Tier 2 (T2) OTC securities (refer Chart 2).

For instance, T1 credit margins are currently trading just ~40bps wider than T2 despite being two notches lower in credit quality. Based on historical averages, T1s look expensive and should be currently trading a further ~100bps wider.

Some of the bids for T1s are undoubtedly from retail investors reducing their duration exposure by directly accessing T1s on the ASX. But with limited access for direct investment in the OTC market, these investors are largely missing out on the higher risk adjusted returns on offer for major bank Senior and T2.

Looking at our own funds, we’ve had a postive bias towards T2 for much of 2022 and have happily taken T1 bids from ASX buyers and moved into T2. The Yarra Enhanced Income Fund, for instance, has reduced its exposure to T1 securities from ~25% in Jan 2022 to ~18% today, with T2 exposure growing from 23% to 40% in the same period. This is just one example of the benefits that come with active management within a wider opportunity set.

Both the Yarra Enhanced Income Fund and Yarra Higher Income Fund are well placed to perform in a higher interest rate environment, providing reliable income from floating rate average investment grade portfolios on running yields of 3.0% and 3.7% respectively.

0 Comments