Phil Strano, Portfolio Manager of the Yarra Absolute Credit Fund, explains why he expects the supply of new income securities will be limited in 2021.

As we’ve recently detailed, we fully expect demand for income to increase in 2021 as investors face up to the challenges of finding yield in a market where the cash rate sits at just 0.10% and term deposits now earn substantially less than 1%.

So while we expect the lure of earning attractive, lower risk yield in our portfolios will see higher demand for spread products (bonds, FRNs, loans, RMBS etc.) from corporate, securitised and bank issuers, what is the outlook for new issuance and what impact could this have on returns in 2021?

In short, we do envisage increased demand for spread product will be met by relatively subdued supply, driving continued outperformance in 2021. Here’s why:

1. Maturities: Lower Bank Refinancings Likely

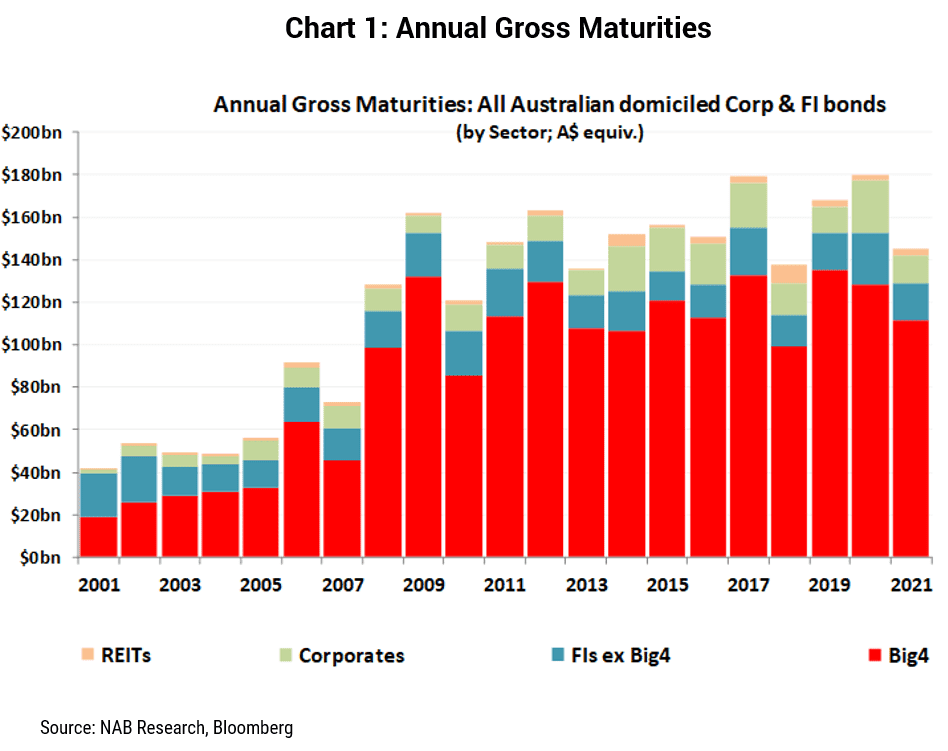

When looking at the likely sources for new issuance, the A$ Medium Term Note (AMTN) market is an obvious starting point, with ~$150b of maturities due in CY21 (refer Chart 1). However, new major bank issuance (80% of total 2020 maturities) is likely to be much lower, with the RBA’s cheaper Term Funding Facility (TFF) (just 10 bps until June 2021) to be the preferred vehicle in most cases for Australia’s major banks. Regardless credit margins of just ~20 bps are of limited appeal for our higher returning portfolios.

2. APRA and Tier 2 Bank Capital: Issuance to Rise

By contrast, we are likely to see increased Tier 2 (T2) issuance fill some of the bank issuance void, with APRA’s requirement for T2 bank capital to comprise 5% of risk weighted assets (currently ~2%) by 2024 requiring a ~$40bn net increase in T2 holdings over the next three years (refer Chart 2). At attractive credit margins of ~+150/200bps (depending on market conditions), these securities form a key component of our higher returning portfolios.

3. Business and Housing Investment: A Steady Supply of Corporates and RMBS

Business investment, an important barometer of potential new supply, is expected to finally rebound in 2021 following a prolonged period of contraction (refer Chart 3). While not necessarily flooding the market, ~$23bn of additional business investment is supportive for additional spread product coming to market this year and beyond.

Also supportive of new spread product in 2021 is the strong growth in housing finance, with fiscal and monetary stimulus in 2020 resulting in a significant uptick in home loan approvals (refer Chart 4). This should result in a steady stream of new residential mortgage backed securities (RMBS) issuance at attractive pricing.

4. Other: Corporate Hybrid Issuance Looks Promising

Another new source of spread product supply in 2021 is likely to be corporate hybrids. Following the successful issuance by Ausnet and Ampol in late 2020, others are expected to follow suit in 2021, preferencing cheaper debt funding options and reducing reliance on equity markets to do the heavy lifting.

As we look towards a (hopefully) less disrupted 2021, we see potential for steady supply of spread product in 2021, certainly sufficient for building large diversified portfolios. We expect the increased demand for spread product will exceed supply in some segments, helping to support the continued outperformance of Yarra’s portfolios in 2021 and beyond.

0 Comments