Phil Strano, Portfolio Manager of the Yarra Absolute Credit Strategy, looks at the current state of the Australian corporate hybrid market.

Many of us old enough will remember the once thriving ASX listed corporate hybrid market as a constant feature of the pre-GFC Australian credit landscape, with the innovatively named Multiplex SITES, Fairfax PRESSES and Dexus RENTS securities offering returns and features to meet the risk appetites of many credit investors.

Post GFC, the souring of Australian investor sentiment towards corporate hybrids and reduced capital needs from issuers generally has gradually seen most corporate hybrids redeemed, leaving bank and insurance names as the hybrid mainstays, particularly on the ASX.

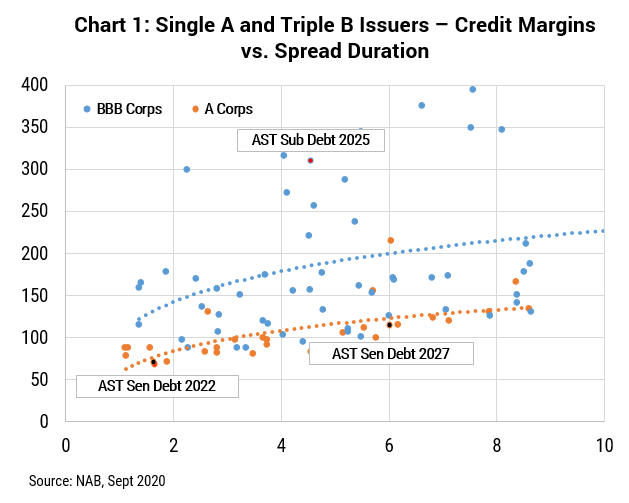

Fast forwarding to 2020, and if we are marking the return of the corporate hybrid market in ‘Star Wars’ terms, the recent issue of the AUD Ausnet Services (AST) 60nc5 corporate hybrid would best be described as The New Hope. Oversubscribed, the $650m deal was issued in the over-the-counter (OTC) market at an attractive credit margin of +310bps, roughly 3 times the comparable senior bond credit margin (refer Chart 1).

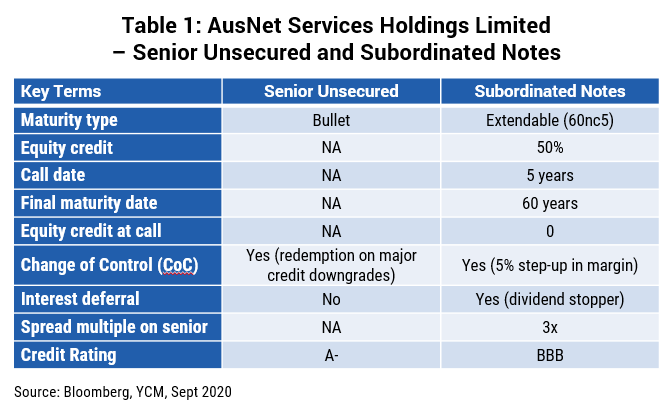

So why are investors being paid three times the credit margin of AST’s senior bonds, and does this corporate hybrid represent attractive risk adjusted returns? Overall, the margin is much higher to compensate investors for the inclusion of some equity like features such as the ability to extend maturity well beyond the call date and to defer coupons which enables half of the $650m to count as equity in credit rating calculations from S&P (refer Table 1).

While these features provide AST management with flexibility and reduce the amount of equity capital required to fund the company’s capital requirements, the 60nc5 subordinated note, in our view, remains ostensibly a fixed income security, underpinned by low credit risk and with little likelihood of coupons being deferred or the notes not being called at its 2025 call date.

Our confidence in this regard is based on:

1. Strong dependable cashflow generated from AST’s regulated utility businesses across Australian electricity and gas transmission markets underpinning investment grade credit quality;

2. A commitment to maintain shareholder distributions, reducing the likelihood of coupon deferral given any payments to shareholders would be prohibited if coupons to noteholders were deferred; and

3. Loss of equity credit from major rating agencies if these securities are not called in 2025, which would render them uneconomic from a weighted average cost of capital (WACC) perspective.

Given the high degree of confidence on credit quality, the likelihood of coupons being paid and the call being exercised, the new AST subordinated note at a credit margin of +310bps (or three times that of the senior bonds) offers compelling risk adjusted returns in the current environment.

We’ve added the AST 60nc5 subordinated notes across all our dedicated Australian credit portfolios, with this security contributing to very attractive investment grade portfolio yields of 3.5-4.0%. We hope other Australian issuers will follow in AST’s wake, adding further diversification to the pool of available opportunities for Australian credit investors.

0 Comments