Phil Strano, Portfolio Manager of the Yarra Higher Income Fund, looks at the benefits of active management in what remains a volatile market environment.

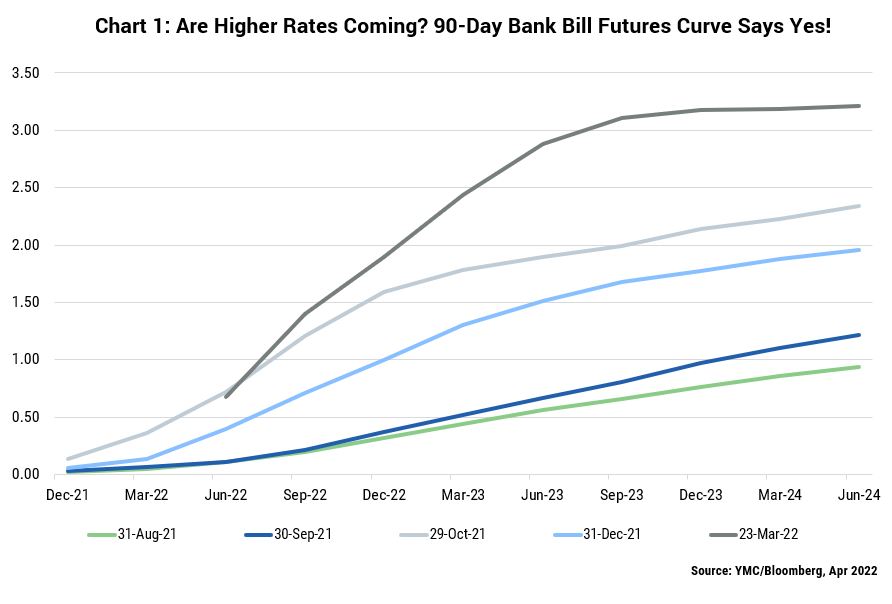

Following a sustained period of higher inflation, complicated more recently by the spike in commodity prices following Russia’s invasion of Ukraine, central banks are increasing interest rates. The Federal Reserve, for instance, has approximately seven rate hikes priced in between now and the end of 2022, with a similar amount also priced into Australian rate markets as indicated by shifts in the 90-day bank bill futures curve since August 2021 (refer Chart 1).

Given renewed uncertainty and tightening monetary policy, it’s no surprise we’ve witnessed more volatility in investment markets. But while higher rates are inevitable, we do not believe central banks will follow through with all the rate hikes currently priced into forward curves. Nonetheless, a decline in liquidity from increasing rates and quantitative tightening will expose some issuers/segments of the credit market.

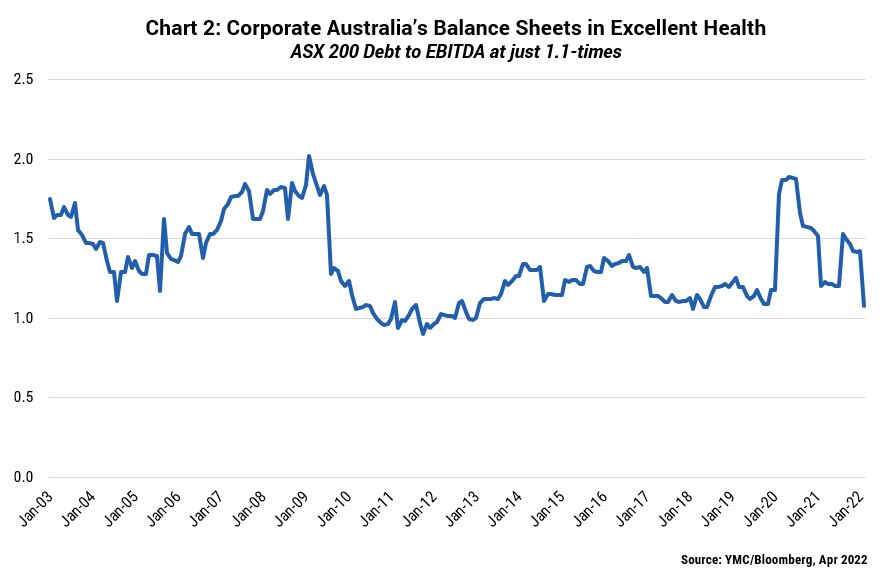

Some slowing of economic growth now looks inevitable, but Australian credit remains very well placed, benefitting from high household savings and fiscal support which has been enhanced by past stimulus and soaring commodity prices. Moreover, corporate Australia is in a strong position to maintain its credit quality, with balance sheets currently their strongest since 2010/11 (refer Chart 2).

While we’d always prefer less tumultuous times – particularly this one, given the humanitarian tragedy unfolding in Ukraine – as active fixed income investors we are attracted to the higher risk-adjusted returns which invariably emerge. And by applying our investment process, we are better able to avoid those issuers/segments more likely to suffer impairments and underperform.

Over the past six months, one area of the market we’ve consistently highlighted as representing higher risk adjusted returns is longer-dated investment grade corporates, either on an outright yield or floating rate hedged basis. These securities benefit from steeper yield curves, especially compared to the cash rate. This sector looks more appealing going into 2Q22 following the moderate widening in credit margins and further selloff in government bonds.

One example is regulated utility Ausnet’s recent high-quality BBB+ rated 6-year bond issue. Priced at a very attractive yield of 4.3%, the security offers very attractive higher risk-adjusted returns. Moreover, we’ve also more recently hedged out our BBSW exposure, locking in a bank bill rate of 1.91% out to the end of 2022 across all our portfolios, comfortable that what is priced into the curve will not be reciprocated by the RBA in actual hikes in 2022. While we do expect the RBA will increase rates in 2022, more than seven hikes seem unimaginable given current economic uncertainties.

In which remains a highly volatile environment, the benefit of active management in fixed income has rarely been clearer. Both of our credit funds – the Yarra Enhanced Income Fund and Yarra Higher Income Fund – continue to offer high risk adjusted returns, yielding 4.76% and 5.20% respectively* from their average investment grade rated portfolios.

0 Comments