In recent months, much has been written about the looming default cycle. The tightening of lending standards in the US does not augur well for high-yield credit. Phil Strano, Senior Portfolio Manager, Fixed Income details why.

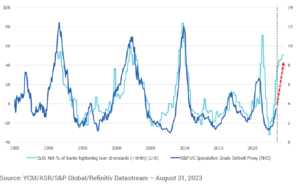

The US typically accounts for a greater share of credit impairments and collateral revaluations compared to the rest of the world. However, Australia’s high yield and private debt markets will not escape its share. In the US, tighter lending standards are pointing towards the most significant default cycle since the Global Financial Crisis (GFC), with the potential for default rates to rise into the high single digits or even higher (refer Chart 1).

Chart 1: US Senior Loan Officer’s Survey and High Yield Defaults (%)

Despite this, money allocated to sub-investment grade loans and private debt in Australia shows little sign of abating. Institutional and retail investors are attracted to these investments due to their higher yields and the prospect of zero volatility, i.e. security/portfolio valuations not independently valued or marked to market. Moreover, given it remains a relatively small segment of the Australian credit market, a sizeable allocation to levered loans, for instance, very quickly results in beta asset concentrations.

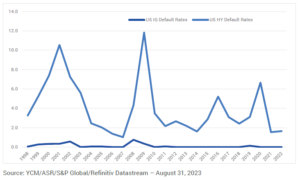

Against this backdrop, we question whether investors are focusing on headline returns while potentially neglecting to consider risk adjusted returns. Investors may be discounting the high yield impairment cycles, such as those witnessed during the early 1990s recession, the millennium dotcom bust and the GFC. By contrast, high yield and investment grade defaults remained virtually non-existent throughout these periods (refer Chart 2).

Chart 2: S&P US Investment Grade and High Yield Defaults

In our discussions across both institutional and retail channels, it is evident that investors are acutely sensitive to negative credit returns. Having experienced negative returns from spread volatility during the GFC, investors increasingly preferred exposure to portfolios that are not marked to market, generally of weaker credit quality and offering minimal liquidity.

This strategy has proven successful over the past decade, with central bank quantitative easing maintaining liquidity and capping defaults. However, following the end of quantitative easing and a shift toward more hawkish central bank policies, this period of relative stability is drawing to a close. Importantly, where spread volatility represents a temporary loss of capital, i.e., you get your money back as markets normalise and spread duration shortens, defaults/impairments represent a permanent loss of capital.

The protective benefits of higher outright yields equally accrue to liquid investment grade credit portfolios. As discussed previously, yields of ~6.5-7.5% and spread duration of ~2-3-years, such as our investment grade rated credit portfolios, would most likely require a GFC style spread widening event over 12 months to generate a negative return. In these scenarios and at this stage of the cycle, we are confident our portfolio returns will stack up well against many private credit funds due to their elevated risk and liquidity profile, which are likely to generate a permanent loss of capital from a default cycle.

Overall, it seems the post-GFC era dominated by quantitative easing and low defaults has come to an end, signalling a return to more normal business and default cycles. With that, investors should pay more attention to credit risk and the increased likelihood of defaults/impairments sullying returns. By contrast, higher quality investment grade portfolios should outperform in such an environment.

0 Comments