If current share prices accurately reflect the extent of the forthcoming property devaluation cycle, many Office A-REITs will be in breach of their gearing thresholds and will require alternative sources of funding. Corporate hybrids, in our view, appear an obvious solution. Phil Strano, Senior Portfolio Manager, Fixed Income details why.

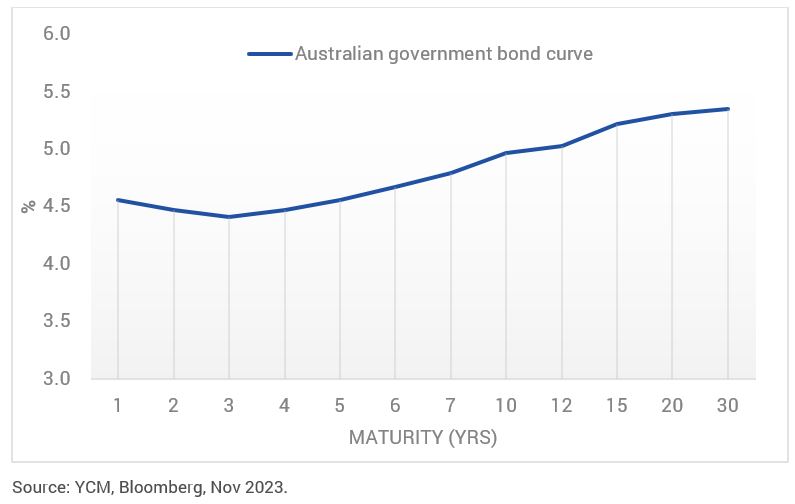

As the world adjusts to the combination of higher interest rates and the increased likelihood of a soft landing, the recent sell-off in bonds has markets fixated on interest rates remaining higher for longer. For instance, Australian Government bond yields are now averaging above 4.5% across the curve, with the yield on the 10-year maturity approaching 5.0% (refer Chart 1).

Chart 1: Australian Interest Rates are in ‘Higher for Longer’ Territory

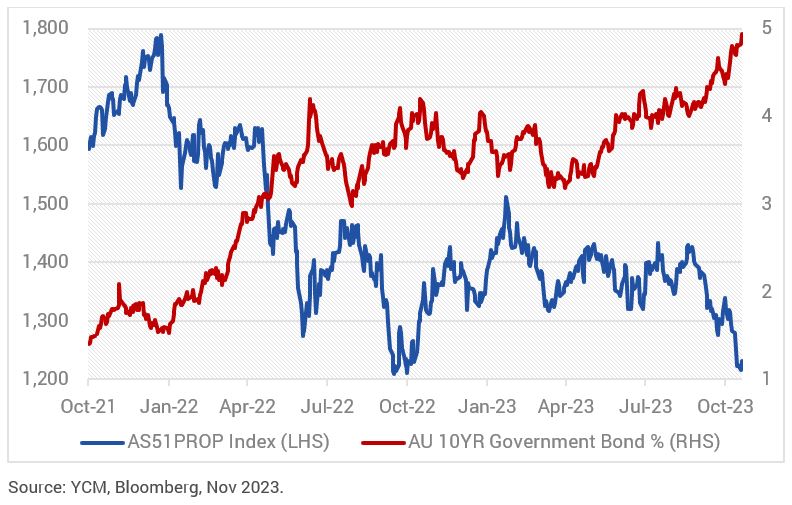

The 10-year government bond yield is an important benchmark for valuing long duration/stable income generating assets with changes in bond yields generally negatively correlated to equity values. Given their long duration and low growth commercial property portfolios, REIT sector valuations are particularly susceptible to higher bond yields. Since their December 2021 peak, ASX REIT sector valuations have declined by 30-35%; implying a significant devaluation of their commercial property portfolios on the back of sharply higher interest rates (refer Chart 2).

Chart 2: ASX REITs Have Had a Challenging Two Years

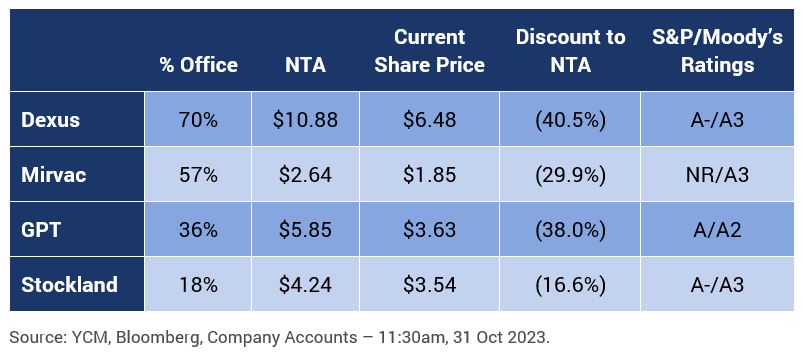

In addition to the challenges that come with higher rates, new supply in the office sector (~1.1% p.a. to 2027) is coinciding with low physical occupancy (~50-60%) and higher vacancy rates (~13% and rising). These structural issues are reflected in underlying valuations with office exposed REITs generally attracting the largest share price discounts to net tangible assets (NTA). If sustained, current discounts to NTA are suggestive of a potential very painful devaluation cycle ahead (refer Table 1).

Table 1: Office REITs Trade at Significant Discounts to NTA

Currently, Dexus, Mirvac and GPT have discounts to NTA ranging from 30-40% due to more significant office exposures and/or rising vacancies. Despite having a higher percentage of office assets than GPT, Mirvac’s discount to NTA is currently less due to its exposure to the more prized residential development sector (also favoured by Stockland).

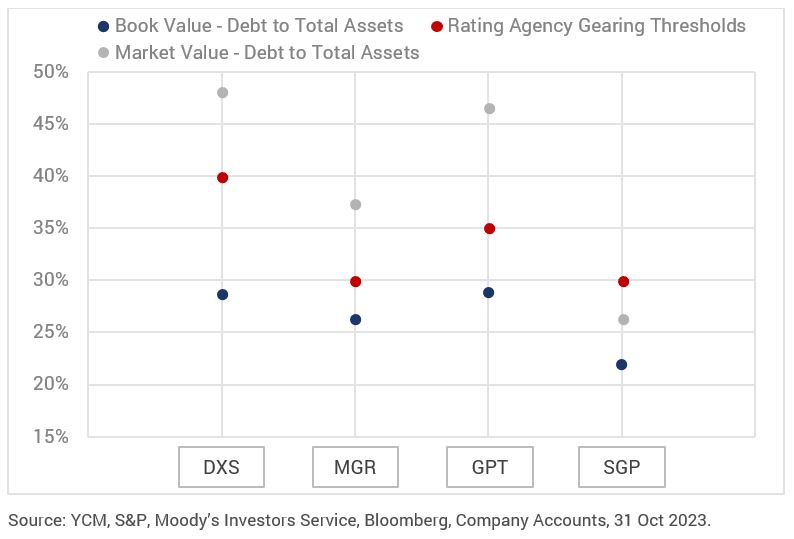

Critically, if current share prices accurately reflect the extent of property devaluations to come, DXS, MGR and GPT would all be in breach of their credit rating agency senior debt gearing thresholds. In each case, the market value of debt to total assets significantly exceeds the maximum gearing allowable for their single A category investment grade credit ratings (refer Chart 3).

Chart 3: REIT Gearing – Book vs. Market Values Tell Very Different Stories

In this environment, many Office REITs will be forced to reduce the quantum of senior debt on their balance sheets and will require alternative sources of funding to ride out this cycle. Any wholesale effort to sell assets and/or raise new equity would effectively lock in current market pricing and be very expensive. Facing this reality, we expect that issuing more corporate hybrids/subordinated debt will be by far a most cost-effective solution.

Under these circumstances, raising new capital from corporate hybrids in an underutilised part of the capital structure for most, should protect REIT senior credit ratings and relieve near to medium term funding pressures. A prominent feature of the Australian market prior to the GFC and used sparingly since, Scentre Group (SGC) issued $US3 billion in corporate hybrids at the height of COVID shutdowns in 2020, which successfully protected its senior credit rating and eliminated the prospect of issuing much more expensive equity. We expect more Office REITs to follow this more recent example and access the corporate hybrid market over the next 6-12 months for more cost-effective headroom.

From an investors’ perspective, we would welcome the return of REIT corporate hybrids. New issue yields of ~9-10% would screen attractively, as would the strong available asset protection – overall dynamic LVRs (based on current pricing) would likely remain at ~50% or less.

For our Enhanced Income portfolio, the return of REIT corporate hybrids will add another avenue for higher risk-adjusted returns to our already large opportunity set, further enhancing our ability to maintain an average investment grade portfolio rating and sustainable 6-7% running yields for the foreseeable future.

0 Comments