After a prolonged period of very low returns, Australian fixed income investors are now spoilt for choice, with investment grade portfolios generating high quality ~7% yields. And as Phil Strano (Senior Portfolio Manager) points out, higher underlying income also significantly diminishes the likelihood of any negative returns over a 12-month period from any sustained widening in credit spreads.

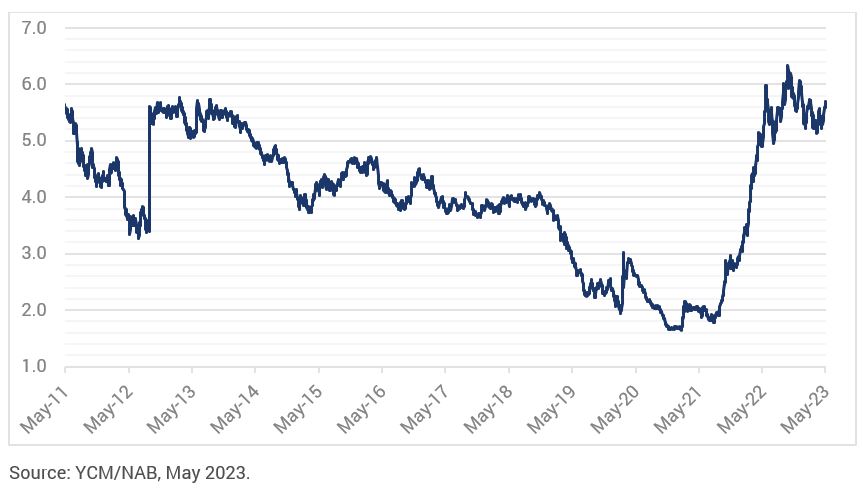

With central banks tightening monetary policy to contain inflation, most of us are well aware of the higher yields now on offer in fixed income. Certainly, in concert with the rapid increase in cash rates, Australian investment grade BBB yields are trading at their highest levels since the GFC and the European sovereign debt crisis (refer Chart 1).

Chart 1: Australian 5-year BBB Yields (%)

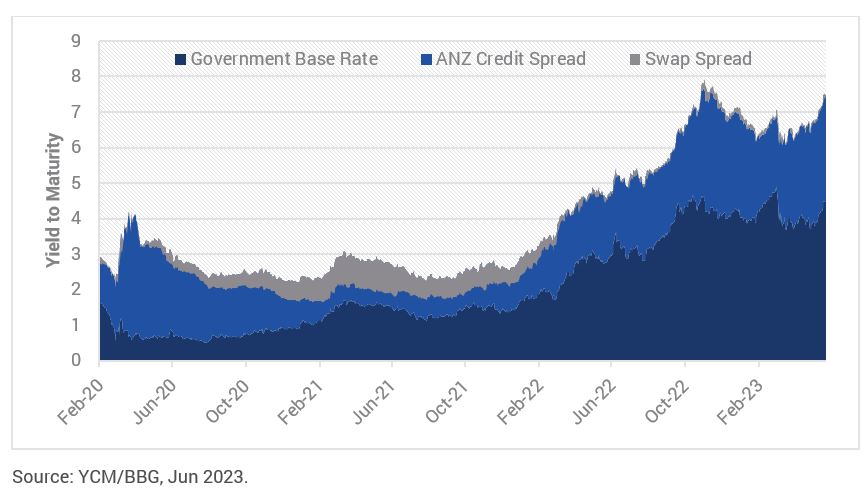

From paltry yields of 2-3% in 2021, the highs of ~6-7% today mark a dramatic change in the environment for investment grade credit returns. For us, this new period has us gladly talking about the market’s attractive outright yields. That said, as attested by the BBB+ rated ANZ T2 2030 securities (refer Chart 2), all sources of return are materially higher on their 2021 levels and contributing to these attractive yields. i.e. much higher base rates and higher credit spreads as well.

Chart 2: ANZ US$ T2 Security – 2.95% 22/07/2030

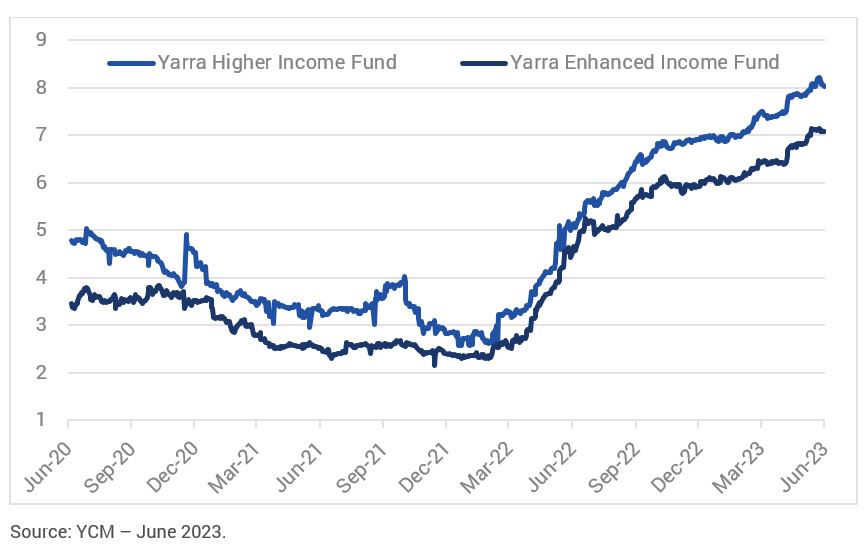

Investors are now generally being well compensated for all aspects of risk, with the most recent Tier 2 deals from Westpac and QBE providing further confirmation. On June 19, Westpac priced BBB+ rated 5-year and 10-year securities at very attractive yields of 6.49% and 6.93% respectively. Similarly, on June 21, the BBB rated QBE 6-year Tier 2s were priced at an attractive credit spread of 310 bps which equated to a yield of ~7.3%. In addition to Tier 2, investment grade RMBS is also offering very attractive risk-adjusted returns with low-risk single A and BBB tranches currently generating floating rate yields of ~8-9%. As for our two major credit funds (Yarra Enhanced Income and Yarra Higher Income), approximate yield to maturities now range at highs of ~7-8% from average investment grade quality, significantly above their 2021 lows (refer Chart 3).

Chart 3: Yield to maturity – Yarra’s Credit Funds (%)

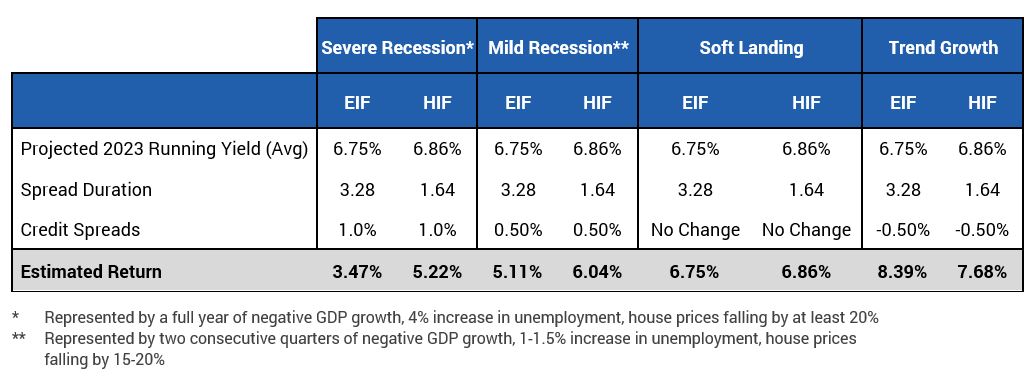

Both the Yarra Enhanced Income Fund (EIF) and Yarra Higher Income Fund (HIF) seek to provide strong return profiles, with the additional yield from high-quality investment grade portfolios also providing investors with important downside protection. With a soft landing or mild recession (not our base case) more likely, both EIF and HIF continue to generate positive returns in our worst-case scenario of a severe recession accompanied by a sustained 100 bps widening in credit spreads across the entire portfolio (refer Table 1).

Table 1: Running (income) yield and potential return scenarios

With their current ~6.5-7.0% running yields, Yarra’s EIF and HIF portfolios seek to provide an attractive alternative to private debt, offering defensive income from highly liquid investment grade portfolios, with lower impairment risk and transparent pricing.

0 Comments