Hysterical commentators continue to crow about the pending crash in Australian housing and plummeting new housing starts. This is despite resilience in the existing housing market, with prices +1.2% year-on-year, -0.5% quarter-on-quarter, as at the end of March 20181.

While it often makes for interesting reading, in our view such commentary often casts aside the critical points. Specifically:

- The overwhelming majority of value in housing starts comes from single-family and semi-detached housing (79% of value, resilient) and not from apartments (21% of value, a glut)

- Single-family housing drives the majority of building materials demand, not apartments which are less material intense

- Single-family homes require on average 3-5 times the amount by value of building materials as high-density apartments and twice that of medium density apartments3

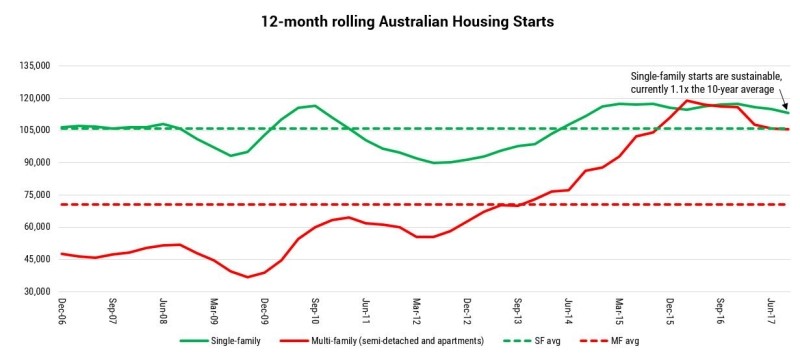

- Loose credit, exuberance from foreign purchasers and solid rental prospects caused a flurry of construction activity for apartments which is now mean reverting (particularly in Brisbane and Perth). This is unsurprising, given National Apartment approvals have been running at an elevated level of 1.8-times the long-term average

- Single-family home starts are only 1.1-times the 10-year average (see chart) and we believe are likely to improve and not implode as some have forecast

In our view, the outlook for the single-family home market is vibrant and is supported by strong lead indicators, including:

- Single-family housing approvals (Feb-18) are up a healthy +6% year-on-year

- Strong and broad-based employment growth (3%+ year-on-year)

- Very strong population growth (+400k p.a., +1.6% year-on-year), underpinned by strong +250k p.a. net migration (i.e. 700 people a day!)

- High prices for existing homes are helping to stimulate new construction (+7.6% p.a. nationally, last 5-years)

- Low mortgage rates (4.6% vs. 10-year average of 5.5%)5

- New land lots being 10-20% smaller than prior years, further assisting affordability6

In an environment where many investors are reacting to bold headlines (or tweets for that matter), large opportunities are emerging.

Finally, for anyone worried about the banks’ exposure to high rise residential development in Brisbane and Perth it is worth calling out that it totals $400mn each for CBA and WBC out of respective loan books of $740bn and $685bn. These exposures are seemingly well secured, with LVRs of 57% and 50% across CBA and WBC’s residential development portfolios.

Our funds have established a significant position in CSR which is directly linked to single-family home market (minimal exposure to apartments). Interestingly it is trading at a very modest (in our view) 13-times F19 P/E as investors fret over the ‘housing’ exposure.

1 CoreLogic, March 2018, national change in dwelling values

2 ABS – Residential Construction Work Done (CWD) as at Dec-17, and JPM Research (building material conversion assumption). Resultant value estimates for CY2017: Single Family housing 52%, Multi-family housing 48% (Semi-detached 27% and Apartments 21%)

3 CSR presentation, Material penetration intensity per Building Segment

4 ABS, 12-month rolling apartment approvals

5 UBS, weighted average residential borrowing rate

6 Stockland (largest land lot vendor in the country) has reduced its average land lot by 15% over the past 4 years (453 to 387 sqm)

0 Comments