Roy Keenan, Head of Australian Fixed Income at Yarra Capital Management, details why COVID-19….

Pandemic related volatility in ASX-listed major bank hybrids over the past month presents investors with a once in a cycle buying opportunity. While the decline in capital values of all risk assets is a warranted reaction to an unprecedented situation, there is ample evidence to suggest that much of the decline in major bank hybrid capital values has been driven by investors’ shared experiences of the global financial crisis (GFC) rather than current realities.

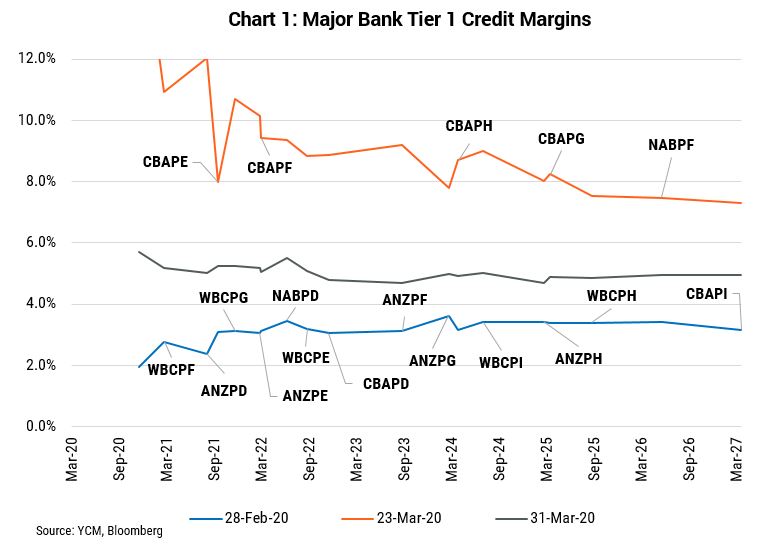

At their month wides T1 securities were trading at levels reminiscent of GFC highs and have since rallied, but are still trading at ~double the credit margins of late February (refer Chart 1).

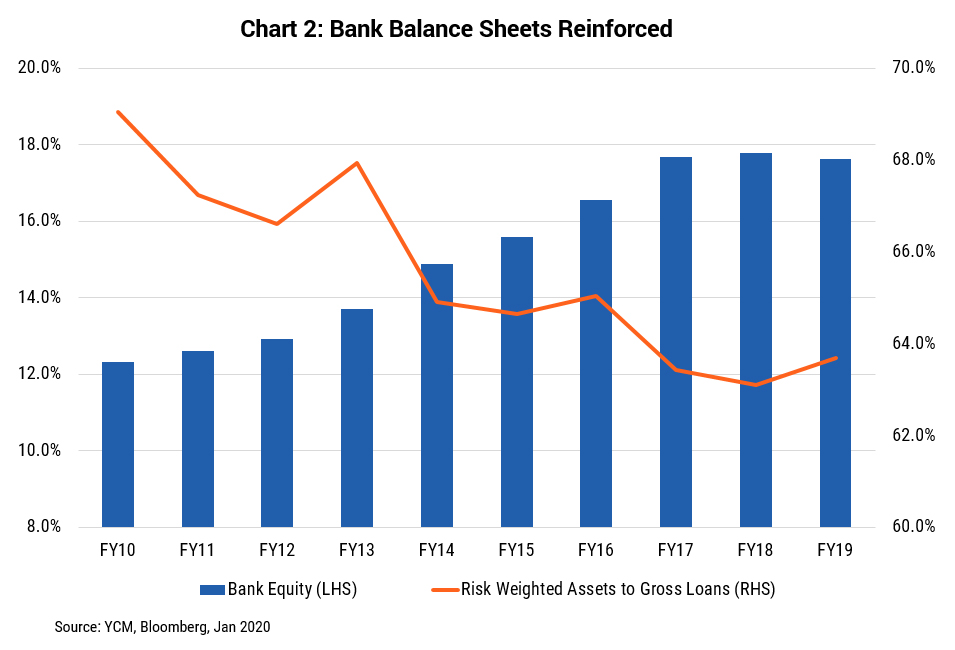

Whereas bank balance sheets were exposed by the GFC in 2008/09, requiring varying levels of direct government assistance, financial regulators have spent much of the last decade strengthening bank balance sheets (refer Chart 2). For credit investors, much higher equity buffers along with a commensurate reduction in risk weighted assets has significantly increased the resilience of bank balance sheets across the debt capital structure.

At its most volatile, the COVID-19 sell-off in major bank hybrids at the end of March coincided with a pre-announced conversion of NAB Capital Notes, with some in the market incorrectly interpreting a planned underwritten conversion of T1 capital – where hybrid holders received their full face value in cash – as a solvency issue. We took this opportunity to increase our holdings in Tier 1 bank securities and ASX listed corporate debt like Crown Resorts where the risk reward scenario is compelling.

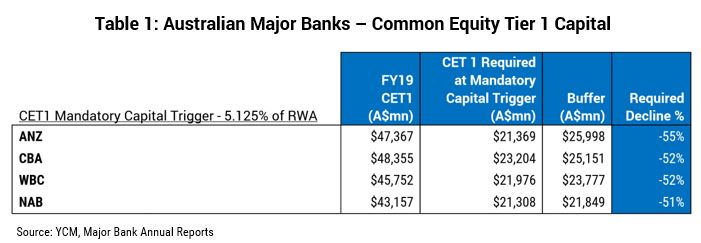

Going into 2020, major bank common equity tier 1 (CET1) capital buffers sat well above APRA’s theoretical CET1 floors of 5.125% (refer Table 1), with cumulative buffers for the big-4 equivalent to ~5% of Australian GDP, providing comfort in the magnitude of losses required before major bank T1 securities are mandatorily converted. Moreover, fiscal stimulus from the Federal government since February of ~10% of GDP further diminishes the probability of mandatory conversions from the major banks.

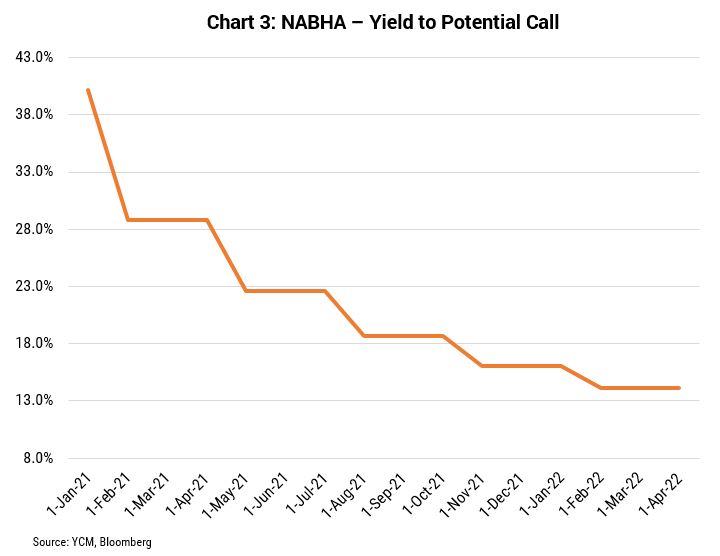

One security worth highlighting which features prominently in our portfolios is the BBB rated NAB Income Securities (NABHA) (refer Chart 3).

We remain very comfortable in our investment thesis, with the NABHA securities to be called in the next 18-24 months at par, with the recent decline in capital values expected to generate investor IRRs greater than 10%.

0 Comments