By Phil Strano, Senior Portfolio Manager, Fixed Income

It has been a fascinating recent few weeks in markets to put it mildly, as hybrid market participants manage the fallout resulting from the forced merger of Credit Suisse and UBS, which follows the collapse of US banks Silicon Valley Bank ($209bn of assets) and Signature Bank ($110bn of assets).

Staggeringly, while the CS/UBS merger announcement will provide CS shareholders with a small capital return, alternative tier 1 (AT1) holders have been wiped out, despite expectations they would rank ahead of equity in the bank’s capital structure.

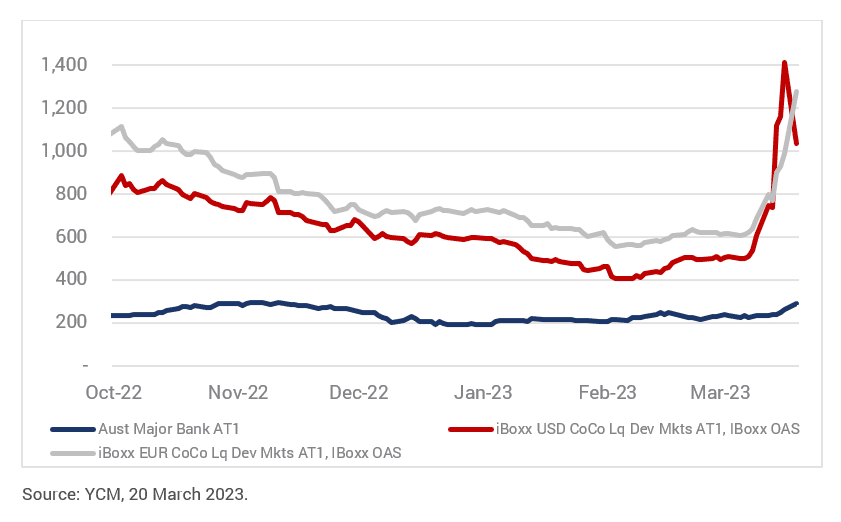

Not surprisingly, this move from the Swiss National Bank (SNB) upended orthodoxy and has caused significant volatility in AT1 markets, with credit spreads gapping wider across most offshore AT1s. Albeit more muted, this latest bout of volatility also widened credit spreads for the perennially expensive ASX listed domestic AT1s (refer Chart 1).

Chart 1: ASX listed domestic AT1s

If we were to extrapolate the SNB’s decision across all markets and jurisdictions, AT1s – which require additional compensation given they can potentially rank below equity on any wind-up event – would fast become uneconomic. The SNB’s actions suggest AT1s should conceptually yield more than bank equity, and this is now playing out in offshore markets.

This volatility is creating some compelling opportunities. For instance, following the SNB announcement, we purchased the 2026 ANZ USD AT1s at an attractive $A cash yield of 8.7% which compares very favourably to ANZ’s fully franked equity dividend yield of ~5.5%.

Given the extreme volatility observed through AT1 markets, we do not believe the SNB’s actions will be replicated in other jurisdictions. The European Central Bank (ECB) and the Bank of England (BOE) have already reasserted the pre-eminence of AT1s over common equity in any wind-up.

That said, a regulatory overhang on pricing could persist for some time, which in many ways could prove similar to the post-GFC credit insurer price overhang. This period saw credit spreads for high-quality Australian utility and infrastructure bonds – whose AAA rated credit insurance was voided due to monoline bankruptcies – trade well wide of the uninsured bonds from the same issuers for years. This was despite credit quality of the underlying issuer being identical and monoline documentation being irrelevant outside of any default scenarios.

The same could be said for Australian major banks, where the relevance of any regulatory overhang for AT1s is dependent on the strength of the jurisdiction’s banking system and its individual banks. That said, wind-up scenarios over the near to medium term appear extremely unlikely. Australia’s banking system is tightly regulated, well capitalised, highly liquid and backed by strong asset quality.

On this basis, any spread premium on offer represents purely a more attractive AT1 entry point rather than compensation for additional risk from any unfavourable treatment on a wind-up scenario. Australian major banks maintain high common equity tier 1 (CET1) ratios of between 11-12%. Looking specifically at CBA, factoring in an extreme downside scenario of a 30% decline in house prices and ALL mortgages above an 80% LVR (~10% of the book) defaulting only reduces CET1 by between ~2-2.5% to ~9%. This is well above AT1 conversion triggers of 5.125%.

We remain attracted to the spread premia on offer for Australian major bank hybrids, principally offshore AT1s and attractively priced T2s (all markets). While we’ve been generally underweight $A denominated AT1s across our funds, this is not a reflection on credit quality but rather a call on relative value compared to higher quality and more compelling T2 securities.

Any domestic market regulatory premium building into credit spreads will likely see us move back into AT1 as we have in offshore markets.

0 Comments