As investment managers, one of the most important – but also one of the hardest – things to do is knowing when to admit you’ve made a mistake. And errors of judgment can happen frequently in investment – in-depth research, strictly applied investment philosophies and disciplined portfolio execution are all critical tools that can help minimise risk and create robust investment portfolios capable of generating strong long-term returns, but they can’t predict the future.

So, recognising the need to revisit an investment thesis, or when to reverse a trade entirely, is a lesson all investment managers need to learn. For us, that time came midway through last year.

AI: a technology game changer

We started 2023 being wary of the technology sector. Many firms within the sector had benefited from the prior cycle of cheap money, leading us to have concerns that such firms would suffer in a tighter spending environment compounded by higher capital costs.

What we hadn’t anticipated was the rapid emergence of a new form of technology that would structurally change the prospects not only for the tech sector itself, but could also have much wider economic and social implications.

AI is not new a technology. In fact, its history can be traced back to the 1950s. But what changed on 30 November 2022, with the launch of ChatGPT, was the emergence of usable generative AI and machine-learning tools that have the potential to completely transform the business world in the decades ahead.

Suddenly, the future pathway for the technology sector shifted dramatically. AI will likely define a new era of technology adoption, making it a secular driver of growth that is independent of broader economic trends. Businesses and governments will need to invest in AI or risk being left behind. AI has become the new arms race.

Applying a Future Quality lens to AI

Having discerned that there’s more to AI than hype, we conducted rational and focused research to ascertain the extent to which AI overlaps with the principles of our Future Quality philosophy. Not only did we conclude that AI is a tangible, long-term trend, but we were also able to identify a host of reasons for why capital expenditure on AI should grow rapidly.

The cost of undertaking machine learning and AI is massive; leading-edge computers are required to handle these models and datacentres will need to be scaled up. The tech titans are leading this AI spending, dipping into their deep pockets as they perceive AI as a way to deepen the moats around their franchises. Similarly, governments are also allocating funds to capture the military capabilities of AI and its utilisation in modern warfare.

This deep dive into AI clearly established that the sector would benefit from a very real and tangible tailwind that would likely endure for the next decade or longer. While our bottom-up, stock-picking investment approach centres around finding Future Quality companies – those which are able to grow, attain and sustain superior returns on invested capital and have key quality pillars in place (Franchise, Management, Balance Sheet and Valuation) – we are not averse to harnessing long-term structural themes that will help drive that growth.

AI undoubtedly represents one such driver, but we also track several other so-called ‘mega themes’ in order to identify other investment prospects and ensure our portfolio benefits from a diversified set of independent growth drivers. At present, we see long-term alpha opportunities from enablers of the energy transition; the normalisation and structural growth in global travel following pandemic-imposed restrictions; and among the providers of more efficient healthcare at a time when the world’s population is ageing rapidly and there is a great need to reduce the cost of health services worldwide.

A Future Quality case study: Nvidia

Once a trend has been robustly ascertained, the next step is to look at the set of players to identify who will be the likely winners and losers. To do this, we looked back at previous waves of technology adoption – there have already been several over the last few decades – and found that leading hardware providers have dominated. They have had first mover advantage and have taken the lion’s share of profitability. In the mainframe era, the winner was IBM. In terms of PC adoption it was Intel, and for smartphones it has undoubtedly been Apple.

So, when we looked at hardware spend on AI, we found that one name currently leads the pack: Nvidia.

Nvidia ticks all the boxes of our Future Quality thesis. It has long-term leadership in the provision of the GPU/DPU technology needed for leading-edge AI, making it the partner of choice for many key technology customers (Franchise). It has stable management and scores highly in terms of both corporate governance and human capital development (Management). Its balance sheet is strong, with net cash, high free cash flow returns and further share buybacks are expected (Balance Sheet). As one of the magnificent seven stocks that led the stock market advance last year, its share price may have already appreciated significantly, but we forecast an enduring period of high growth (Valuation).

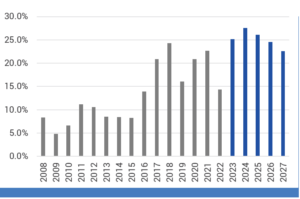

Chart 1: Nvidia cash return on equity (%), 2023 – 2027

Source: Nikko AM forecast, as of August 2023.

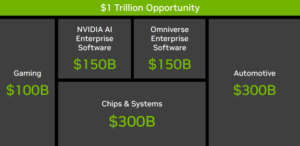

Having affirmed Nvidia’s Future Quality credentials, we purchased the stock in August 2023. As the dominant semiconductor provider, we believe Nvidia will maintain its growth trajectory amid an acceleration in the market for AI-compatible chips, as well as its additional software services. In short, we see this as a US$1trillion opportunity.

Chart 2: The opportunity for Nvidia

Source: Nvidia, August, 2023.

How AI helped re-focus a business: Meta

We also considered how AI is being applied by other technology businesses.

While Meta – the owner of Facebook and Instagram – was always on our watchlist, we no longer held the stock within our portfolio as we felt its heavy investment in developing the metaverse represented a poor return on capital and perceived that the business had taken its eye off the real revenue driver of its business model of selling advertising to large and small businesses around the world.

Fortunately, Meta’s management recognised the error of its ways, redeploying capital into AI and using AI to reinforce its core franchise. This is already delivering a notable impact; people are spending more time on its platforms and Meta has already seen its share of global advertising revenue go up – a particularly notable feat during a time when the advertising cycle is under strain from a more depressed economic environment.

This change in business strategy has resulted in a notable improvement in Meta’s returns on capital and better growth prospects. We now believe that Meta once again meets our Future Quality criteria, as its outlook now aligns with our expectations of sustained and superior returns, and as a result we have reintroduced the stock back into our portfolio.

Identifying the leaders of the AI revolution

Investing isn’t an exact science. Trying to pick winning businesses over a 5-10 year horizon is not an easy task and errors will inevitably be made, especially when new trends emerge. However, for seasoned investors, the ability to acknowledge such mistakes and take appropriate action is the key to long-term, successful investing. For us, that means re-evaluating an investment thesis based on our Future Quality criteria. Our research shows that AI is a new paradigm that will have significant investment implications for the future and shouldn’t be ignored or avoided. However, as with every nascent development, the successful adopters of AI and the ultimate winners are not yet evident, so we will proceed with caution rather than run with the herd. Our focus remains on finding Future Quality businesses with a visible pathway to future growth, regardless of whether they are AI-aligned, affiliated with another megatrend or have their own robust idiosyncratic business case, but all are connected by our Future Quality investment philosophy.

The Yarra Global Share Fund is invested in the Nikko AM Global Equity Fund managed by the Global Equity Team of Nikko Asset Management Europe.

The Global Equity team is a proud partner of Future Generation, an Australian-based social impact investment organisation that supports children and youth mental health.

0 Comments