Dion Hershan, Head of Australian Equities, looks at the August reporting season in the large cap equities space, where he assessed company results based on “the COVID-4”.

At a headline earnings level, this year’s reporting season was probably less meaningful than any other in living memory.

Following three quarters of ‘normal trading’, FY20 was epitomised by one quarter of ‘chaos’ as company earnings reflected the initial impact of COVID-19 and related policy responses. But with continuous disclosure obligations having dramatically reset expectations from April onwards, consensus (for ASX 200 EPS to decline around 15% in aggregate) was a low bar to trip over.

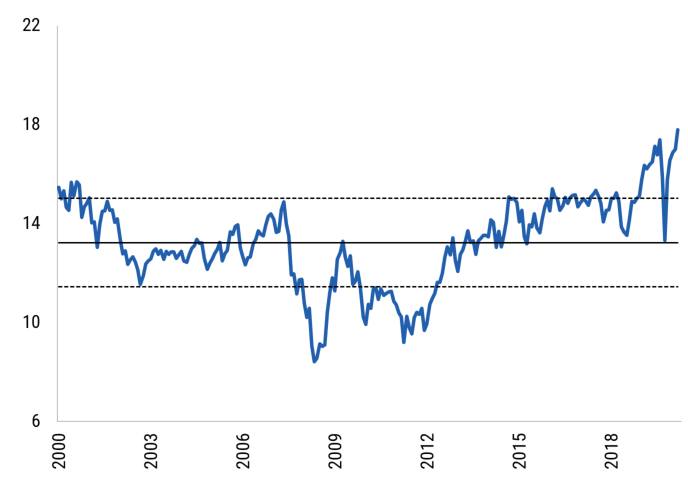

Forward guidance for FY21 wasn’t terribly helpful either. More than 50% of companies didn’t provide it at all and management commentary was either cautious or absent[1]. As a result, the ASX 200’s performance (+3% in August) and its now stretched valuation (rising to a 2-year forward P/E of 18 times[2]) (refer chart) was almost independent of reporting season.

Chart 1 – ASX 200 2-year forward P/E

Source: FactSet Market Aggregates, 31 Aug 2020

Rather than focus on headline data compared to less reliable consensus forecasts, we instead assessed company results and their outlook in the context of which COVID-impacted group they belong to:

1. Short-term beneficiaries (e.g. Retail), which we believe are experiencing a pull-forward in demand which will dissipate as the environment normalises (as we recently wrote about);

2. Structural accelerators (e.g. online retail, data centres), which have taken advantage of COVID-19 to expedite their growth plans;

3. The disrupted cohort (e.g. travel, infrastructure, REITs, Energy), which have experienced a large hit to earnings which may be either temporary or more long term in nature, and;

4. The COVID “indifferents” (e.g. mining, telcos), which have been largely unaffected by the pandemic and do not face the same degree of uncertainty.

Within the structural accelerators, we are overweight NEXTDC, JB Hi-Fi and Coles. The data centre operator, unlike its peer group, has earnings growth locked in as it meets the demands of large clients. And while consumer electronics and supermarkets

also overweight temporarily disrupted sectors Transportation Infrastructure and Energy and are selectively positioned in “indifferents” across both mining (BHP Group, Iluka Resources) and Telcos (TPG and Vocus).

Our Australian Equity portfolios remain well-placed to exploit growing market inefficiencies across the market, preferencing those companies where we see either sustainable earnings growth or a disconnect between valuations and the recovery.

0 Comments