Phil Strano, Portfolio Manager of the Yarra Absolute Credit Fund, looks at Australia’s Term Funding Facility and what its demise means for debt investors.

At the height of last year’s volatility in March, the Reserve Bank of Australia (RBA) announced the Term Funding Facility (TFF) as part of a comprehensive package of measures to support the economy by ostensibly suppressing yields. The TFF provides low cost 3-year senior funding for banks at the prevailing cash rate of 25 bps (later lowered to just 10 bps).

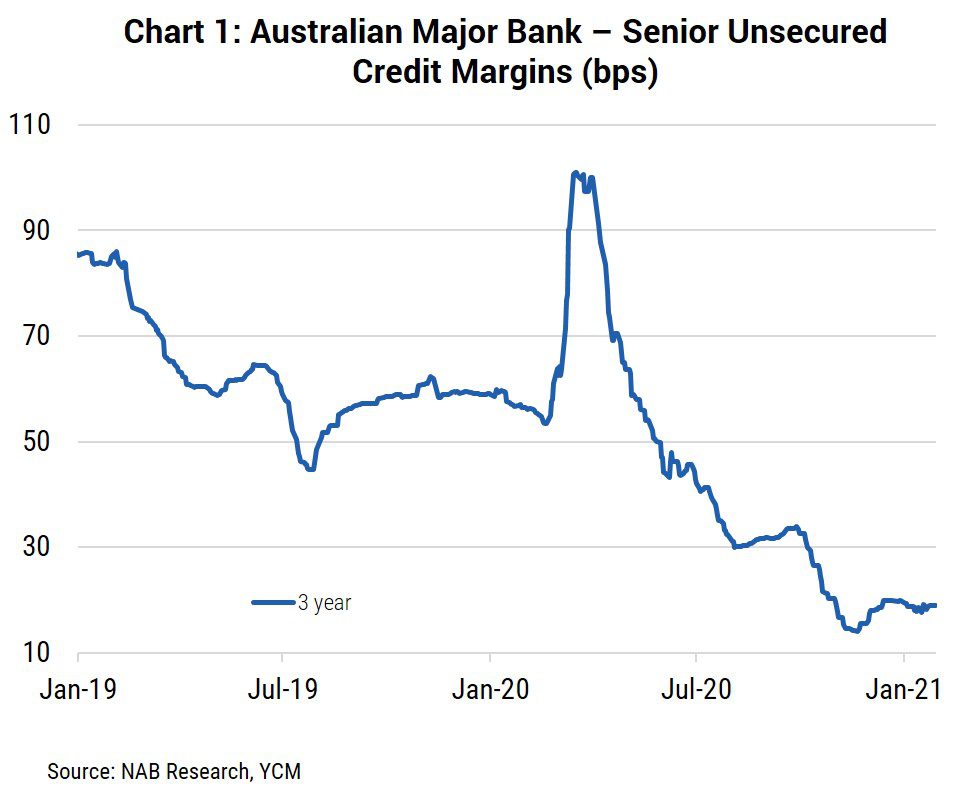

With 3-year bank senior peaking at 100 bps in March 2020, the introduction of the TFF was sufficient to meet much of the banking sector’s requirements for senior debt. It had a predictable impact on credit margins, with the subsequent decline in supply of senior bank paper and suppression in yields driving a collapse in bank senior credit margins to ~20bps currently (refer Chart 1).

With its outperformance since March 2020 resembling in many ways the smooth conditions referenced in Christopher Cross’ ‘Sailing’, last month’s announcement by the RBA that the TFF would end in June 2021 is expected to generate headwinds and end the compression in bank senior credit margins. Albeit an important stabiliser at the height of volatility, the TFF has distorted funding markets, and we expect its removal will see bank senior credit margins – especially in the 3-5 year part of the curve – normalise to approx. 50 bps (average), a level more reflective of underlying credit risk.

Just how long this normalisation takes will depend on the supply of new senior bank paper and performance of markets more generally. Banks will likely forward fund some of their needs, meaning that new issuance is likely to be limited in CY21. Unsurprisingly, we do not own any senior bank paper given the poor risk reward, preferring to own undistorted T2 and T1 bank capital.

Which brings us to the issue of what impact, if any, rising bank senior credit margins will have on T2 and T1 securities. We believe any impact on T2 and T1 credit margins from the TFF’s demise will be muted, reflective of their more attractive risk-reward and elevated multiples to senior. Prior to the pandemic, our rule of thumb had T2 and T1 credit margins trade at roughly twice and four times senior.

By virtue of distorting bank senior credit margins, the TFF pushed these multiples to extreme levels (refer Chart 2), providing us with confidence in the outlook for T2 and T1 credit margins. Whether they Ride Like the Wind remains to be seen, but we can see significant scope for outperformance, with margins potentially returning to their pre-pandemic multiples as senior credit margins adjust to a less distorted reality.

While the TFF’s demise may provide a headwind to returns in some segments of the market, our well-diversified and risk-adjusted portfolios are well placed to ride out any volatility and continue delivering consistent income.

0 Comments