In a period where dispersion in markets is set to rise from depressed levels and volatility will widen further, stock picking and making active and well-researched calls should be as relevant as ever. In this latest Insights piece, Dion Hershan, Head of Australian Equities, details why.

We all know that averages can be absolutely useless in periods of significant dispersion. And while it’s tempting to look at aggregate numbers in Australia and be seduced into believing we are in ‘normal times’, this clearly neglects the key point: dispersion is back with a vengeance.

The dispersion we’re already seeing will be evident across the board: in economic outcomes, corporate earnings and in turn share price performance. Pockets of resilience will coincide with localised/niche recessions.

A summary glance at aggregate numbers for Australia would be comforting (based on consensus).

- GDP is forecast to grow at 1.7%

- Unemployment is expected to rise just 0.1% in 2023 to 3.8% before rising to a still low 4.4% in 2024

- The federal budget is in surplus in 2023, a sharp recovery from a pandemic low of -12.5% of GDP

- Resources and rural goods remain buoyant, and for the 12 months to March 2023 were $427bn above their 2020 pre-COVID levels (17% of GDP)

- Inflation is set to trend down to 2.7% by 2025, a decline of 510ppts (from a starting point of 7.8% in Dec 2022)

- ASX 200 EPS earnings are forecast to hold flat for FY24-25

However, the devil is always in the detail, and it is apparent that the forward experience will be very uneven in Australia. It is worth noting:

1. The proportion of earnings upgrades to downgrades is currently the worst since the COVID-19 pandemic impacted period of 1H20

- 50% of companies missed EPS expectations during the last reporting season. This is despite reporting season overall being fine, with F23 consensus only moving by -1.6% in March 2023

2. Consumer pressure will be pronounced at the bottom end

- The $270bn saving buffer is heavily skewed to wealthier households over the age of 45. Indeed, the impact of the shifting fiscal and monetary stance will have sharply different impacts by age groups and by income distribution. We estimate that the discretionary cashflow for the bottom 20% of Australian households will plummet 24% in 2023

3. Almost 900k Australian households have a mortgage buffer of less than three months (9% of total mortgage holders)

- This is despite the often-cited reference that Australians are well ahead on their mortgages on an overall basis

4. The 12-month decline in Australian household wealth is the largest fall since the GFC

- Despite property prices being 12% higher than pre-COVID levels, the combination of falling asset prices (financial assets and housing) has driven a 3% decline in household wealth over the past 12 months (equivalent to $605bn). Meanwhile, household debt increased a further 5% over the past year which, when combined with the lagged impact of interest rate rises, will see total debt servicing hit record levels in 2H23

5. Australian commodity prices, while elevated, have fallen 20% in the past year

- This includes a 23% decline in both rural commodities and base metals and an 18% decline in bulk commodity prices

6. Earnings dispersions are widening

- The industrial sector (37% of ASX 200) is set to grow earnings by 10% in FY24, however 100% of that can be accounted for by 10 companies, and 70% by just four companies (Xero, CSL, Transurban and NextDC).

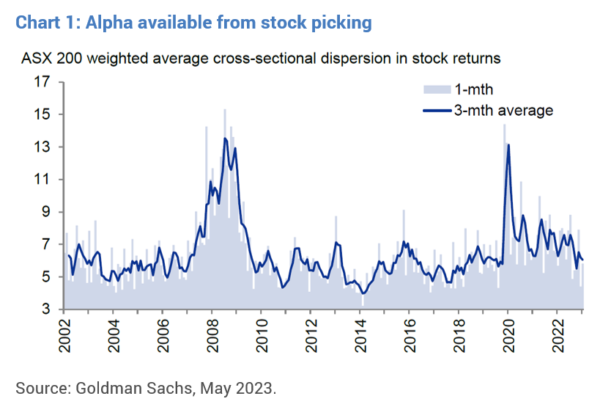

With both the opportunity set and the risk profile clearly elevated in this environment, it’s time for a scalpel rather than a sledgehammer. In a period where dispersion is set to rise from depressed levels (refer Chart 1) and volatility will widen further (e.g. IT and Resources) (refer Chart 2), stock picking and making active and well-researched calls should be as relevant as ever.

In our large cap portfolios, we have recently added to holdings in Iluka (niche commodities) and Tabcorp (industry structure improving) for micro rather than macro reasons.

Yarra’s Broadcap Australian Equities portfolio has delivered strong outperformance (+641 bps y/y, +366 bps p.a. over 3 years*) and we remain focused on navigating what remains a steeply uneven environment.

0 Comments