Roy Keenan, Head of Australian Fixed Income and Portfolio Manager of the Yarra Enhanced Income Fund, details the backdrop to one of the Fund’s key securities.

Now part of the Woolworths South Africa business, department store retailer David Jones qualifies as an excellent case study in the differing approach of fixed income investors to their equity market counterparts. While the past 12 months have highlighted the trading challenges a global pandemic brings to physical retailers, investors in the debt securities of David Jones have had a much happier time of it.

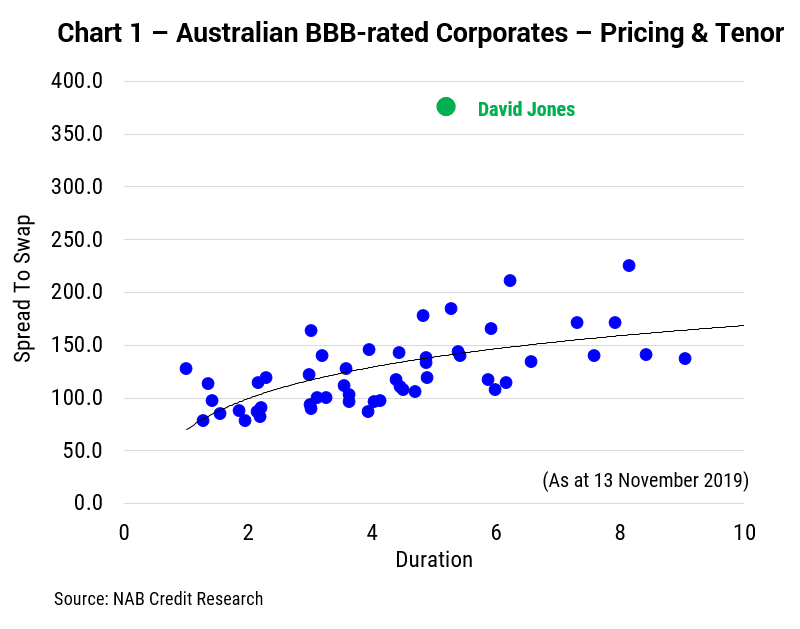

Issued in Nov-2019, the unrated over the counter (OTC) 6-year David Jones (DJS) notes were priced at a credit margin of +375 bps and with a 75 bps BBSW floor (i.e. floor yield of 4.5%). Internally rated by Yarra at BBB-, the deal issued at approximately double the credit margin of externally rated peers and, in our view, represented compelling value (refer Chart 1).

A key reason driving our decision to invest in the DJS securities was the senior security of the notes, which were backed by a first lien mortgage over $1bn of property with a loan to value ratio below 50%.

Pleasingly, our thesis is now playing out: the parent company’s recent decision to sell the Sydney property and undertake a debt restructure compels the early redemption of the notes, consistent with those first lien mortgage rights. The sale and debt restructure is expected to be completed in Mar-2021 and will see our notes fully redeemed at par value.

The strength of Yarra’s analysis, which we don’t believe was particularly well understood by the market, has withstood the COVID-19 challenge and the resulting change in management strategy. Stepping back from the chaos of COVID enabled us to use the selloff to add to our position at materially discounted valuations, significantly increasing returns to end investors.

While we remain cautious on the Australian retail sector, the structure of the DJS issue provides an excellent case study. Our low investment grade internal credit rating for these senior secured notes reflected:

- Positive free cash flow from 2020 onwards of ~$50-60mn p.a.;

- First lien mortgage rights over high quality freehold property;

- Conservative loan to value ratio of less than 50%; and

- Strong covenant protections precluding significant new debt issuance.

Our decision to invest in the DJS notes reinforces the benefits of combining a fundamental and independent investment process with a flexible mandate, enabling the targeting of higher risk-adjusted returns in Australian credit.

The Yarra Enhanced Income Fund offers stable, regular income, and currently provides unitholders with a yield of 3.09%[1]. Since its inception in 2003, the Fund has established a long track record of achieving its performance objectives, significantly outperforming the RBA Cash Rate and delivering annual distributions (incl. franking) of 6.23% p.a. For further information on the Yarra Enhanced Income Fund, please click here or contact a member of the firm’s Distribution Team.

Roy Keenan

Portfolio Manager, Yarra Enhanced Income Fund

[1] Running yield as at 31 January 2021.

0 Comments