The upcoming reporting season is likely to be a challenging one for the smaller companies market, with meaningful earnings downgrades to come. Michael Steele, Co-Portfolio Manager of the Yarra Australian Smaller Companies Fund, explains what his team is focused on ahead of this August reporting period.

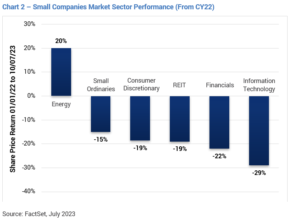

The upcoming reporting season is likely to be challenging for the smaller companies market, with meaningful earnings downgrades to come. While these earnings headwinds are partly already reflected in share prices – the Small Ordinaries is down 15% since start of CY22 – the equity market is likely to in many cases extrapolate and overreact to what are, in our view, mostly just short-term cyclical earnings headwinds creating compelling opportunities for long-term investors.

Our key focus for August will be earnings outlooks for the next 12 months. In our view earnings expectations remain too high (refer Chart 1) and are likely to be revised down during reporting season, with the Small Ordinaries expected to report earnings growth of +20% yoy. We believe this growth is disproportionately driven by Resources & Energy sector earnings growth (+40% yoy) with lower growth expectations from Industrials (+13% yoy) and Financials & REITS (+10% yoy).

The Small Companies market has a range of factors causing downside risk to earnings expectations:

- Macroeconomic headwinds from a slowing global economy leading to lower general demand. Global companies with exposure to Europe and US are more at risk than companies exposed to the Australian economy which is outperforming due to higher population growth and Resources & Energy sector growth.

- Discretionary segments of the economy – in particular Retail – have slowed materially in recent months reflecting pressure from higher costs, in particular higher interest rates.

- Resources & Energy sector earnings downside risk from lower commodity prices, in particular iron ore, coal and lithium.

- Wage pressures remain elevated, with wage inflation high – and in many cases accelerating – which is a negative for people intensive industries.

- Interest cost increases following the dramatic cash rate hikes by the RBA, which will be a material headwind for companies with high debt levels (in particular A-REITS).

While in our view headline market earnings growth expectations remain too high, there are still sections of the Small Companies market that we expect will continue growing earnings in FY24. These include:

- The Travel sector, which is yet to recover to pre-COVID levels, with demand remaining strong given pent-up demand as consumers continue preferencing services over goods.

- The Insurance sector’s continued defensive demand trends, with premium rate rises remaining high and, in many cases, accelerating.

- Health care earnings growth, supported by the earnings starting point in FY23 (i.e. low and depressed) and improving volume and staff availability trends.

- Technology earnings growth, in particular from the full impact of cost reductions in businesses providing durable products with low economic sensitivity.

- Mining services demand from the increasing investment by miners to sustain or increase production volumes, particularly in those commodities linked to decarbonisation (e.g. lithium, nickel and copper).

In many cases, we believe the equity market will extrapolate and overreact to what are merely short-term cyclical earnings headwinds, creating buying opportunities at deeply depressed prices. We have seen evidence of this over the last 12 months, with our Fund adding to positions in Financials and Information Technology off the back of these sectors declining (-22% and -29% respectively) since the start of CY22 (refer Chart 2).

In our view the environment over the next 6-12 months is likely to bring compelling buying opportunities across all sectors (excl. Energy), even in sectors where we have been underweight for many years (e.g. Discretionary Retail and A-REITs).

0 Comments