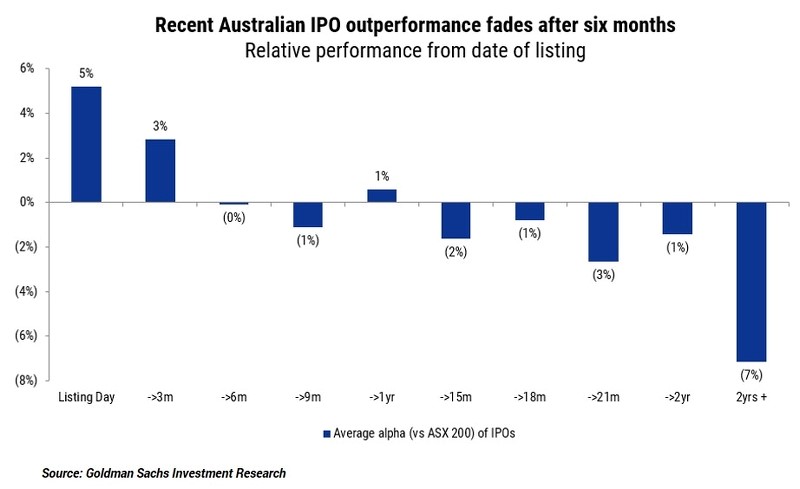

The performance of Australian initial public offerings (IPOs) over recent years has been telling. On average there has been money to be made in the initial trade but this effect has faded after six months, with the average domestic IPO underperforming the market by approximately 7% after two years (refer below chart).

While it is dangerous to generalise on what’s causing the IPO fade, we have observed a noticeable reduction in quality and an increase in price multiples commanded for the most recent crop of IPOs.

Financial sponsors have been the driving force behind just under half of Australian IPOs over the last two years. With an incentive to optimise pricing this may also be an influence. Increasingly we’re seeing vendors retaining shareholdings at IPO, providing comfort to new investors but also creating an overhang with the prospect of secondary market sales.

Higher multiples being extracted by vendors may help explain the short term fade. Not that long ago companies seeking to IPO were frequently priced at a discount to their listed peers, recognising the risk attached to investing in companies with limited, visible track records. However, recently we’ve observed an increase in companies listing at public market multiples, leaving no margin of safety, providing no discount to reflect IPO risk and offering little room to grow into a public market multiple.

Whether the mispricing of IPO risk reflects the scarcity of businesses exhibiting growth, the absence of value or merely the trappings of a bull market remains unclear. But with 31% of IPOs in the last two years missing prospectus forecasts and 43% missing year two consensus forecasts*, the recent crop of IPOs has been a clear disappointment.

This early performance fade and poor medium term performance of recent Australian IPOs is having a clear impact, with investors growing increasingly cautious and demanding an appropriate discount to reflect the risks of investing in companies with short or opaque track records.

On the other side, vendor expectations are yet to be reset, with a high proportion of assets coming to the market struggling to accept the new pricing reality.

With institutional investors increasingly cautious and vendor expectations stubbornly high, the pipeline has completely dried up and there are very few companies currently seeking to IPO. It’s telling there have been only two successful IPOs in 2017 above $50m market capitalisation (half way through the year), in stark contrast to the peak of 41 IPOs in 2014 and the 19 seen in 2016.

Like many investors, we take a cautious approach to IPOs given the narrow decision timeframes (restricting our ability to undertake detailed due diligence), short operating track records and, frequently, forecasts which imply an unsustainable future growth trajectory.

Successful IPOs in recent years – including many private equity backed companies – have typically shared a few common traits: experienced management with strong alignment through ownership, realistic and demonstrable organic growth and strong cash flows. We’ve also seen examples of businesses that are unfamiliar to the market, favouring investors with intensive research processes which are more likely to result in price inefficiencies. And, of course, that IPO discount.…

* Macquarie Research

0 Comments