Dion Hershan, Head of Australian Equities, explains why Yarra’s equity funds have now moved significantly underweight Australian banks.

Australia’s Big 4 banks are no longer the fortress oligopoly they used to be, evidenced simply by the sector ROE going from 21% in 2007 to 10.5% today. Previously returns were the envy of the sector globally, the big 4 are now middle of the pack.

There is no one simple explanation, rather a long list of contributing factors, most of which appear structural rather than temporary or cyclical.

- Competition has intensified dramatically – while the Big 4’s mortgage market share has shifted only slightly in 10 years (80% to 76%), the more telling factor is that brokers have gone from originating 44% to 67% of mortgages over that same period. Loyalty has diminished, branches are less relevant, and brokers simply arbitrage the banks to get the best interest rates, underwriting standards and turn-around times. At the same time, fintechs and alternative lenders (commercial property, direct credit, FX etc) are eroding what used to be very profitable niches;

- Regulatory costs are unrecognisable – intense regulation may have safeguarded consumers, but it has wounded the banks. The cost, capital and staff required to meet surging requirements has clearly come at the expense of returns;

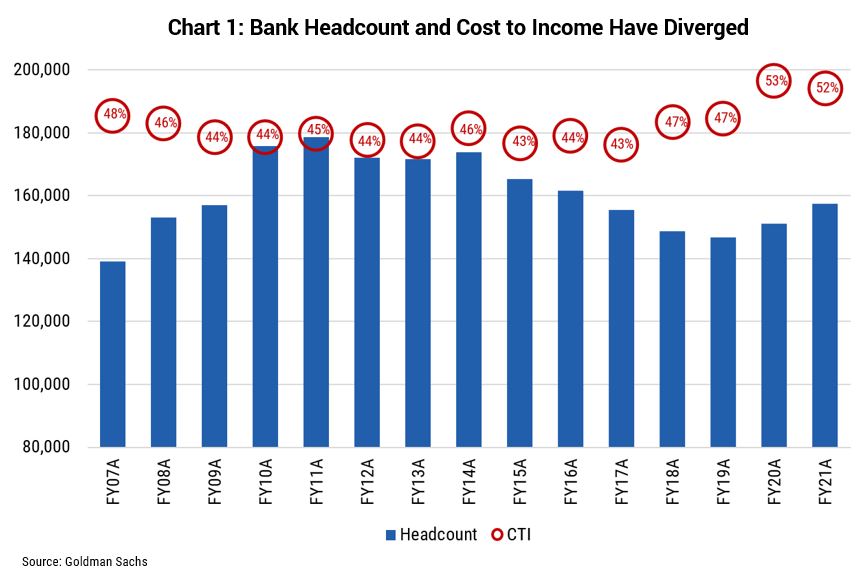

- Cost control more broadly has been lost – regulation (noted above) and an ever-growing requirement to invest in technology is driving perverse outcomes. It seems unfathomable, but over the last decade the banks have reduced their headcount (their #1 cost) by 11% (like for like, excl. divestitures) but increased their operating expenses by 19%. This has smashed cost to income ratios, up from 45% to 52% today (refer chart 1). Real productivity is deteriorating.

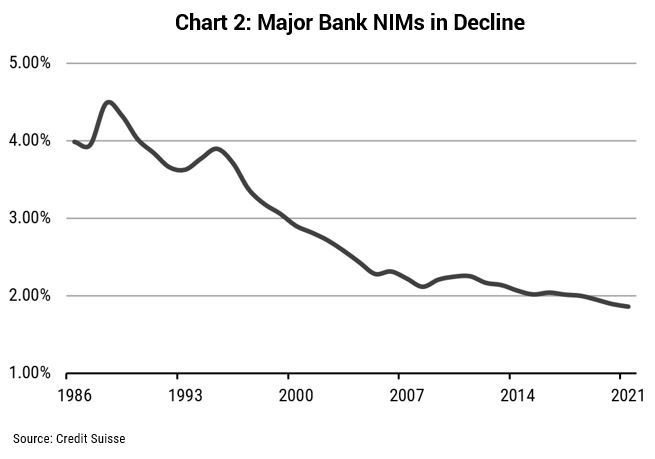

Interest rate hikes might provide some temporary relief for Net Interest Margins (NIMs) as returns on low-cost deposits are enhanced, however the benefits could be short lived. NIMs have been in serial decline for two decades (refer chart 2) and it’s a function of competition rather than RBA settings. It would be brave to assume they sustainably rebound.

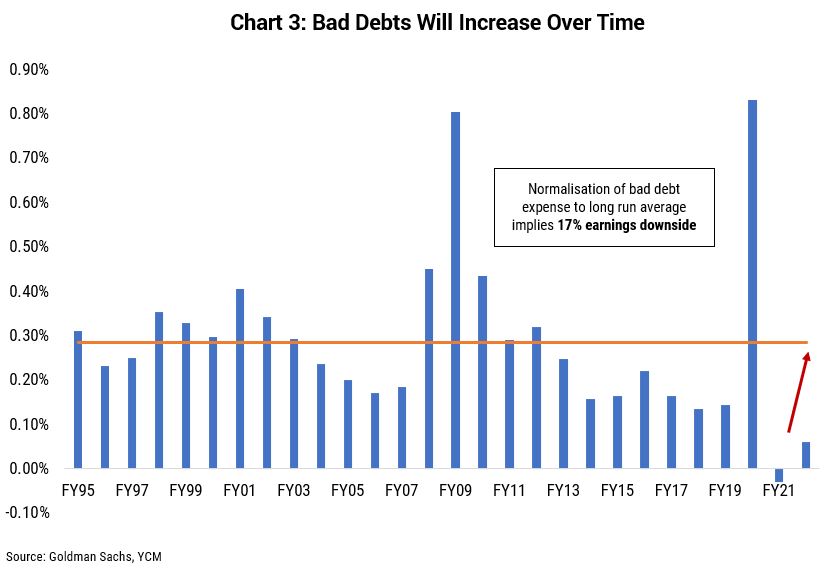

Bad debts today are at all-time lows (refer chart 3) and might well remain subdued for some time, but it would be foolish to assume they remain at current levels over the long term. This represents an important medium-term headwind.

Lastly, while the sector does offer solid dividends (currently yield 4.7%), the prospects for capital appreciation appears modest. With valuation multiples above long-term averages (P/E of 16.3x vs. 12.9x and pre-provision P/E of 9.7x vs. 7.6x) it will likely take meaningful earnings growth to create capital appreciation.

There is a place for some banks in a diversified portfolio, however Yarra’s funds have now moved significantly underweight the sector. The opportunity cost of clinging onto yesterday’s oligopoly is too high when there are compelling opportunities to invest across the telco, media and mining sectors.

0 Comments