As bank issuance shrinks, corporate hybrids are in the ascendance, with non-financial corporate hybrids potentially instrumental in powering Australia’s energy transition. So what do they offer the fixed income investor?

Australia’s hybrid bond market rarely makes headlines, but in recent weeks it has been firmly back in the spotlight. The Australian Prudential Regulation Authority (APRA) recently revealed plans to phase out Australian banks’ use of additional tier one (AT1) capital which APRA believes is riskier, thereby seeking to enhance the overall stability of the banking system. The announcement came on the heels of a surge in interest in corporate hybrids sparked by the successful raising for Australian Securities Exchange (ASX) listed mall operator Scentre Group. Yarra’s outlook for Australia’s hybrid bond market—of which bank AT1 hybrids make up around $41 billion—considers these latest proposed regulatory changes while focusing on the future potential for hybrids in funding corporate Australia’s energy transition ambitions.

Investors and issuers alike are now navigating a market partly in transition. More immediately it seems that in the wake of APRA’s announcement, some are betting that a shrinking pool of Australian bank hybrids will drive up demand, pushing prices higher and yields lower across Australia’s big four banks. Since last month’s announcement, spreads for Tier 1 securities have contracted ~16bps—so retail investors are eager to bid up assets and get a larger slice of a shrinking pool.

While uncertainty prevails in hybrid bank issuance for now, and short-term opportunities may arise, over the longer-term a broader set of dynamics is emerging for hybrids, particularly in sectors like energy and infrastructure.

Expanding role in Australia’s energy transition

The potential scale of the energy transition in Australia offers an exciting growth opportunity for corporate hybrids. As energy transition projects such as new transmission lines and large-scale generation get underway, hybrids can and should play a role in funding the significant upfront capital costs and become a permanent feature of issuer capital structures.

We estimate a total system investment of $400 billion is required by 2050 in order to decarbonise Australia’s energy market with a focus on new energy generation including investment in wind farms, solar, batteries, and associated transmission assets.

It is highly unlikely that equity alone will foot the bill for these expensive projects and that is why we see hybrids as an increasingly popular funding source in Australia’s transition to a low-carbon economy, offering flexibility and capital efficiency.

The sheer size of the capital requirement means that corporates will need to tap into multiple funding sources, and hybrids offer a lower-cost alternative to pure equity issuance.

For large-scale energy transition projects, such as new transmission lines and renewable energy facilities, hybrids offer a way to fund significant upfront capital costs without putting undue strain on a company’s balance sheet.

For that reason, we expect large blue-chip generation companies like AGL, Origin, APA, and even Woodside and Santos along with transmission companies like Austnet and Transgrid, to tap into hybrid issuance as part of their funding strategies for energy transition plans.

The recent success of Scentre’s corporate hybrid raising demonstrates this growing interest from non-financial corporates looking to leverage a flexible funding tool, and we expect this interest to grow from here with further non-financial corporate issuance likely in FY2025.

While APRA’s move signals tighter regulatory scrutiny and a potential decline in AT1 hybrid issuance by banks, there is also the possibility that as major bank issuance retreats in APRA’s suggested 2027-2032 transition period, corporate issuers may step in to fill the gap.

Bringing it back to fundamentals

As the APRA development demonstrates, assessing and pricing the inherent risks of hybrids becomes trickier with regulatory change in the mix. But these upheavals should be viewed as atypical events in a sector that is actually offering attractive returns akin to longer term equity market averages, with the ‘higher for longer’ rates, which are thematic for fixed income assets, here to stay.

We are forecasting a new era for tactical fixed income, characterised by sustained, higher yields. In this environment, investors, particularly those focused on investment-grade assets, are increasingly comfortable holding instruments such as hybrids, viewing the attractive yields on offer as ample compensation for assumed risk.

We see further opportunities for investors to access the higher yields and risk-adjusted returns that have made the hybrid instrument so popular recently.

Further, with APRA’s decision to phase out AT1 hybrids, there is an expected shift of a substantial pool of capital, estimated to be around $41 billion, that will be seeking new investment avenues. This development is likely to create significant opportunities for corporate hybrids to emerge as a viable alternative for retail investors who are in search of yield. Consequently, we anticipate that corporate hybrid instruments could play a crucial role in filling the gap left by the diminishing bank hybrid market. This shift could potentially lead to a resurgence of hybrid issuance on the ASX, ensuring that investors continue to have access to the attractive yields they have grown accustomed to with bank hybrids, but now through corporate issuance by larger, investment-grade companies.

In addition to the rise of corporate hybrids, another area that warrants close attention as AT1 hybrids are phased out is the potential for Bank Tier 2 paper – that is, subordinated debt which provides an additional layer of protection for banks – to become more prominent on the ASX.

It is conceivable that banks may opt for increased Tier 2 issuance as a strategic move to maintain access to retail capital pools and fulfill their capital requirements while they gradually wind down their AT1 hybrid instruments. This strategic shift towards Tier 2 issuance could provide banks with the necessary flexibility to navigate the changing regulatory landscape and continue to meet their capital needs effectively.

Hybrids in portfolio construction

A key performance factor here is the issuer’s credit strength—when dealing with investment-grade hybrids from strong issuers, the chance of conversion or extension is significantly diminished but investors still get rewarded for taking on what are essentially low-probability events.

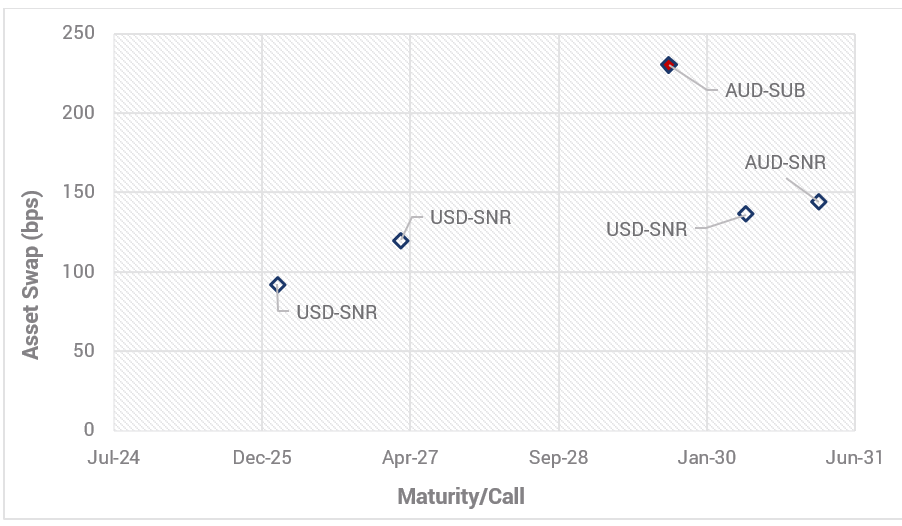

These features allow investors to effectively double the credit spread, significantly increasing returns without taking on a disproportionate increase in risk. For instance, investors in Scentre Group’s recent hybrid issuance picked up a credit spread that was 1.8 to 1.9 times the spread on the company’s senior debt, providing a return close to 6%.

Chart 1: Scentre Group Bond Curve – 4 Sept 2024

Source: YCM, Sept 2024.

Myths about hybrids

There are several misconceptions about hybrid securities that often lead to a misunderstanding of their risk and reward profile, particularly among investors who may equate them with pure equity. One common myth is that hybrid bonds are simply ‘equity in disguise’. While hybrids can have equity-like features, particularly in times of financial stress, as mentioned their risk-reward profile more closely tracks the underlying credit quality of the issuer.

Provided you are investing in high-quality issuers the likelihood of hybrids not being refinanced at their call (redemption) dates or experiencing write-downs should be quite low.

This is why, despite these structural complexities, we believe hybrids offer compelling risk-adjusted returns over both the short and long term. Their attractive yields compensate investors for these theoretical risks, while the actual occurrence of negative outcomes remains infrequent.

This dynamic has made hybrids a popular choice among sophisticated fixed income investors seeking higher returns without assuming the full risk profile of equity.

An elegant solution for balancing capital needs and sustainability goals

For corporate issuers, hybrids offer a number of attractive properties, particularly if a company is looking to fund expensive infrastructure development, mergers and acquisitions, raise capital without having to sell assets, or strengthen their balance sheet.

Because of their ‘hybrid’ nature—whereby half of the amount on issuance is counted as equity and, therefore, not included in that gearing calculation—hybrids can be a great source of capital flexibility. This can mean the ability to run a little bit more debt, negate the need for asset sales, optimise the amount of equity capital, or support and protect a credit rating.

These useful features make them relatively more appealing as a funding instrument for utilities and other infrastructure providers where capital is intensive and locked into large-scale projects with long-term build horizons. That is why we expect hybrids to feature more prominently in Australia’s utilities sector, providing flexible capital sources for the energy transition build, including both for renewable energy infrastructure and energy transition infrastructure.

Scentre Group’s successful, high-profile bond issuance earlier this month placed hybrids and their investment features squarely back in the spotlight, signalling to investors the return of attractive investment-grade hybrids. Coupled with the regulatory changes that may usher in the end of traditional bank-issued hybrid securities like AT1’s, and it is safe to say this is a sector in flux with some eye-catching opportunities ahead.

0 Comments