Tim Toohey, Head of Macro and Strategy at Yarra Capital Management, provides his view on modelling the Australian dollar (A$) and details his initial thoughts on the coronavirus impact.

The Reserve Bank of Australia (RBA) has a strong interest in understanding the drivers behind the A$, not least because the A$ significantly influences financial conditions.

The RBA’s A$ model currently suggests the ‘fair value’ for the exchange rate is 15% higher than the current level. Plugging a 15% higher A$ into the RBA’s new macroeconomic model suggests economic growth would be 1.25% lower over the subsequent 12-18 months. To say that would complicate the RBA’s current plans would be an understatement. With economic growth at a low ebb and the nearer term growth outlook threatened (i.e. bushfires and a dangerous new virus), virtually nobody in Australia wants to contemplate a higher A$. We believe the RBA model has not adapted well to the era of Quantitative Easing and its forecasts are now less reliable. A new approach is needed.

Yarra has now released a whitepaper detailing our preferred exchange rate model. It comes with a warning label: it is long, dense, and admittedly pretty dry. To borrow the Nebraska Tourism Commission’s current catch-phrase – “Honestly, it’s not for everyone”¹.

Yet the intuition behind the model is straight forward, and its conclusions should give pause to most investors when considering their investment strategy for 2020 and beyond. While we are not proposing a radically new economic theory, we have managed to take established theory and make it relevant for the era of unconventional monetary policy. The implications are noteworthy:

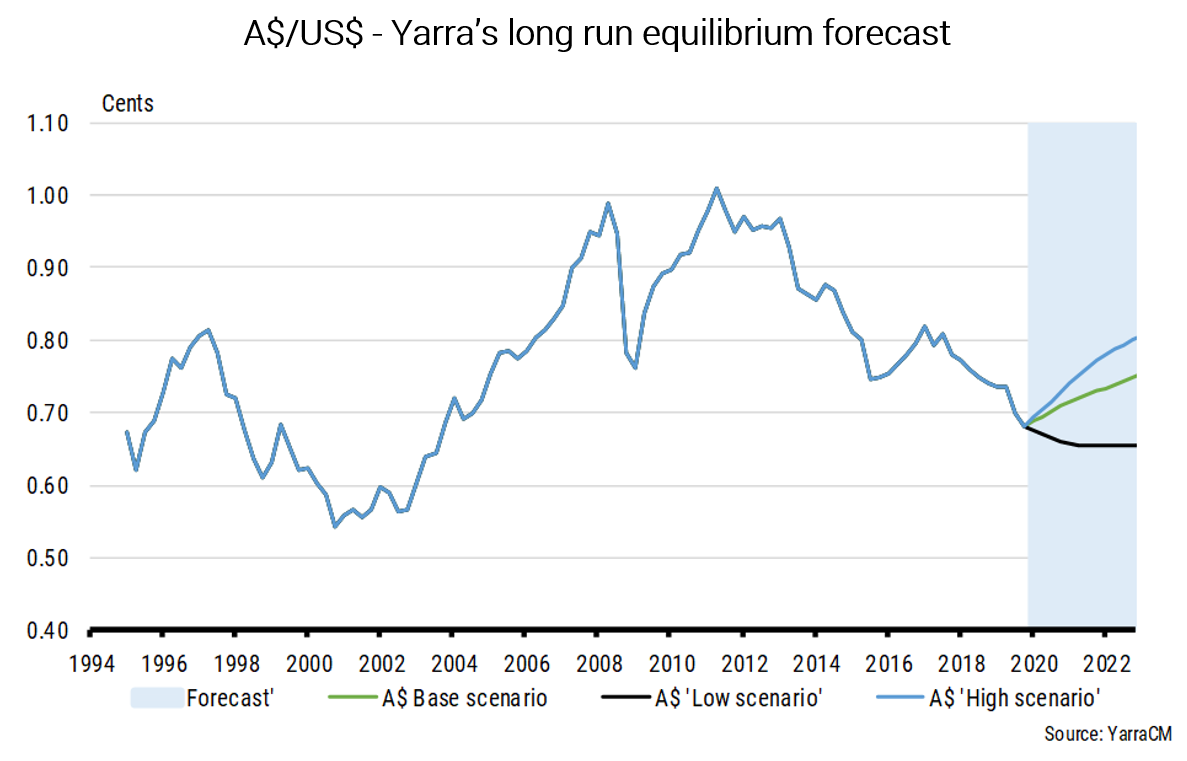

The model’s main innovation is that it replaces relative interest rate spreads between Australia and our trading partners, as used in the RBA’s A$ model, with relative growth in credit. As such, the recent sharp recovery in house prices and improving leading indicators for credit growth suggest an upswing in the A$ in coming months;

Secondly, an upturn in global leading indicators is important for the A$ on several fronts:

- First off, it should provide broad support to commodity prices;

- Further, a broader based economic recovery may limit US equity market relative outperformance, which under our model is A$ supportive;

- Finally, a more positive global outlook should encourage the removal of A$ speculative short positions which accumulated through 2019 and early 2020.

Impact of the coronavirus

There is no question that the uncertainty of the economic impact of the coronavirus is significant. Indeed, it’s a perfect real time example of how short run factors can temporarily swamp the ‘equilibrium’ fair value of the exchange rate.

But is it enough of a shock to alter our medium term positive view on the A$? In short, no.

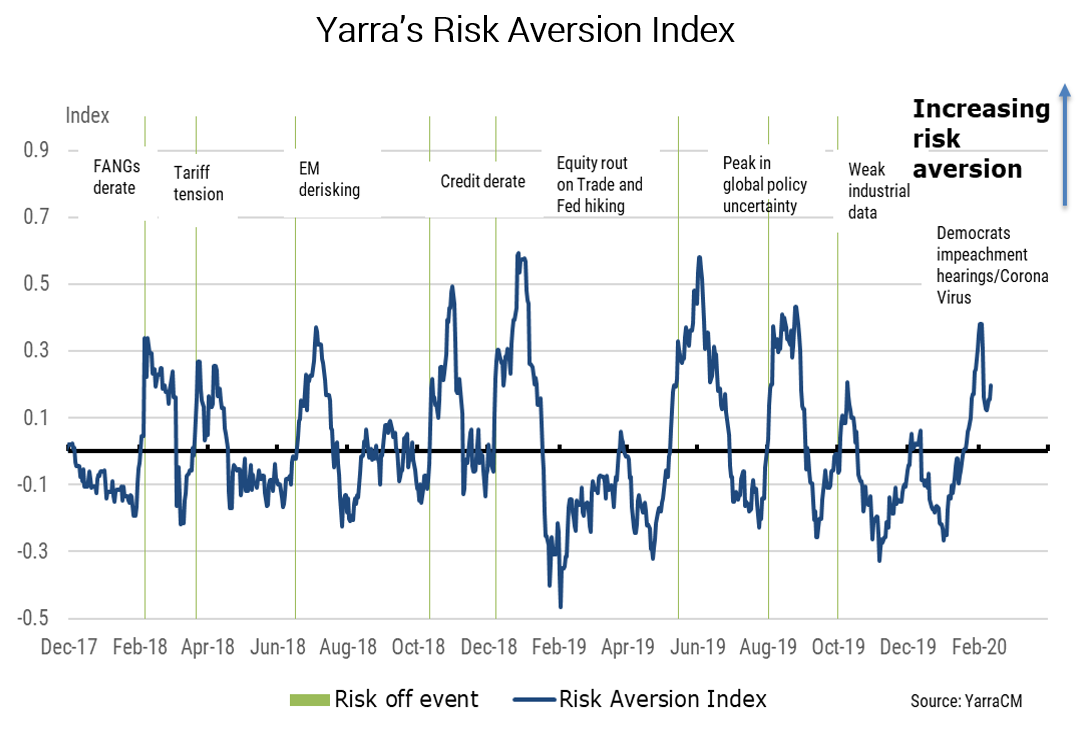

Our working assumption is that China’s economic growth will be 1% lower in 2020, while the combined impact of the bushfires and the virus will lower Australian economic growth by 0.5% in 2020. While these are significant downgrades, much of this impact has already been absorbed via a spike in A$ short positioning through January 2020, the equity market correction and commodity price declines. Our data tells us the level of risk aversion has now peaked, and we are moving to levels where a degree of ‘risk-loving’ behaviour returns to markets.

Exhibit 1: Coronavirus led risk aversion has temporarily pulled the A$ further from fair-value

The Coronavirus is by definition a short run shock that has very real economic and social impact. It has provided a sufficient shock to see the A$ deviate further from its long run path, but it has also induced a meaningful stimulus that will underwrite the economic recovery through 2020-21. We suggest that the stimulus China is currently implementing will remain in place long after the virus is contained.

Exhibit 2: Our base case suggests A$/US$ will rise to 73c by end-2020

Putting it all together, our base case scenario is that the A$/US$ will rise to 73c by end-2020. Moreover, in assessing the plausible range of potential outcomes it is difficult to escape the conclusion that the risks to the A$ are now skewed to the upside.

In terms of the issues that investors need to think about for 2020, assuming that the A$ remains around current levels or declines further is – in our view – one of the more dangerous assumptions.

¹ Nebraska has featured last on a list of states that tourists are interested in visiting, according to the travel marketing research firm MMGY Global for the past four consecutive years.

0 Comments