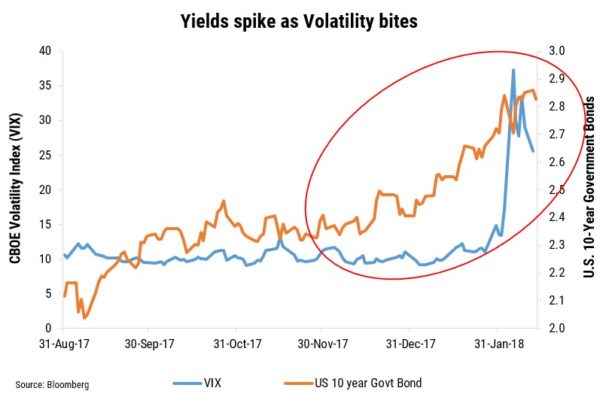

By and large, the decade post-crisis (2008-18) was characterised by central bank liquidity, low volatility and beta rather than alpha being the dominant source of returns. Fast forwarding to today, the most recent uptick in volatility (refer below chart) is finally pointing to the resumption of a more normal market, one more reflective of fundamentals and a return of broader idiosyncratic risks.

If anything, the end of ultra-loose monetary policy should settle the debate between passive and active management, with alpha re-emerging as an important source of return. As the year progresses, we expect this new environment to generate a greater dispersion of performance, making security selection critical, with the more highly-skilled active managers best placed to outperform in a more volatile market. Having an acute focus on fundamental research will, in our view, add significant alpha in this environment.

With rates finally on the rise, stock selection is of paramount importance. Clearly, investors should adjust to this new environment by limiting their exposure to interest rate duration. Moreover, though, investors should also be seeking to limit their exposure to longer spread duration (>7 years) credit and avoid overvalued sectors which have been artificially propped up by central bank liquidity.

More than ever, adopting an absolute return approach for Australian corporate credit maximises flexibility by enabling access to more resilient names/sectors and limiting exposure to overvalued sectors.

Specifically, in our view:

- The AMTN true corporates are generally too long spread duration and have insufficient credit spread (A/BBB ~+100-120bps) to protect against rising rates;

- Australian senior bank paper (AA ~+80bps) continues to look fairly valued and, in our view, offers good liquidity adjusted returns;

- In the Hybrid market we see significant value in the Major Bank 3-year part of the curve where spreads are 5-6 times that of comparable senior paper, yielding investors an approximate return of 5.20%;

- Unlisted loan and ABS sectors (BB ~+400bps) offer the attractive combination of higher risk-adjusted credit spreads and shorter spread duration; and

- With idiosyncratic risk on the rise and market proximity increasingly important, Australian domestic managers would be wise to limit exposure to offshore names. i.e. offshore names are best managed by offshore managers.

As core credit managers, we seek to deliver higher risk-adjusted returns from Australian domiciled credit through the cycle. The firm’s fundamental research capabilities uniquely positions us to take advantage of market mispricing across multi sectors, including unlisted debt, where declining bank participation is increasing opportunities for institutional investors.

0 Comments