Phil Strano, Senior Investment Manager at Yarra Capital Management, explains why the credit profiles of Australia’s major private operators could weaken materially over the near term.

While reporting season confirmed the continued strength of Australian corporates – conservative balance sheets and constructive outlooks were a common thread – private hospital operators were a stark exception, with fundamentals deteriorating due to two notable trends:

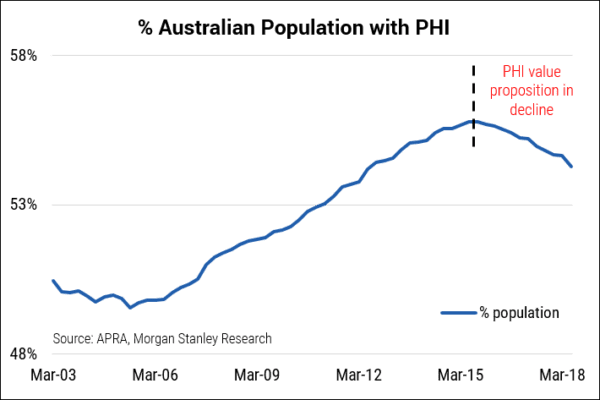

- Patient volumes have declined (Chart 1) due to a more competitive public hospital sector taking market share and falling private health insurance (PHI) participation (Chart 2); and

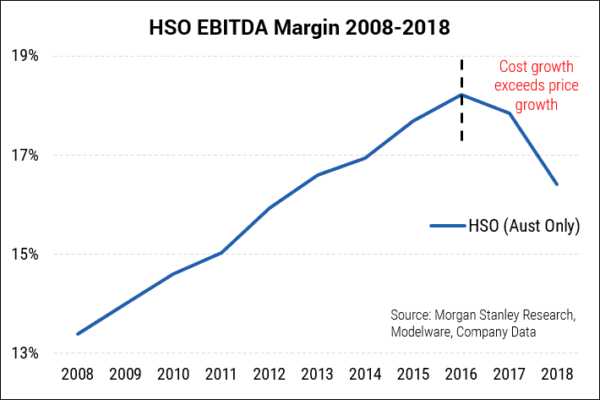

- Margins are being squeezed by insurers on pricing, rising costs (e.g. labour) and patient case mix becoming increasingly skewed towards less profitable procedures.

Chart 1: Private Hospital Market Share in Decline

Chart 2: Private Health Insurance Participation is Falling

Australia’s private healthcare system faces a raft of challenges. With anaemic wage growth and escalating household utility prices, the value proposition of PHI and thus private hospitals is diminishing. Rising premiums (3-5% p.a.) and out-of-pocket expenses are fast putting the private system beyond reach, and a likely (pro-public hospital) Federal Labor government in 2019 would further constrain private operators.

For private sector hospital operators, the outlook appears bleak. Healthscope (HSO) and Ramsay Healthcare (RHC) operate relatively aggressive financial profiles, with operating lease-adjusted leverage ratios (net debt to EBITDA) ranging between 4-5x. Margins are under pressure (Chart 3), and an emboldened public hospitals sector could significantly expose a weakened private sector’s high operating leverage, leaving very little room to move on costs.

Chart 3: HSO margins are Under Pressure

The underlying credit profiles of both HSO and RHC could weaken materially over the near to medium term. Being currently funded predominantly from syndicated bank debt, deteriorating credit quality is likely to impact the financial flexibility of both companies. HSO’s bank debt matures in ~12 months and if current takeover attempts from private equity are successful, it will likely need to re-enter the levered loan market. RHC’s long-dated perpetual security (ASX: RHCPA), meanwhile, currently trades at a margin of ~BBSW+450bps, which offers poor compensation for its deteriorating credit profile.

Critically, there remains only minimal collateral to reassure any nervous creditors; RHC’s property assets are largely already on sale-and-leaseback arrangements and HSO recently announced plans to sell freehold property assets (with potential for capital management initiatives). Minimal physical asset backing, high indebtedness and weakening cash flow generation makes both businesses unappealing prospects.

We much prefer credits such as Peet Group’s 2021s PPCPA (~+370bps) and 2022s PPCPBs (~+380bps). They offer comparable credit quality, more stable outlooks and much shorter spread duration for only a slightly reduced trading margin.

Originally posted on www.livewiremarkets.com.

0 Comments