COVID-19 has caused a large and unexpected shock (I am avoiding using the buzzwords of ‘unprecedented’ and ‘black swan’) that, among other things, has called into question how many of the ‘lessons learned’ from the GFC were actually committed to long-term memory.

While on average most ASX-listed companies have managed the crisis reasonably well, it’s remarkable just how many of them came into this pandemic with insufficient liquidity or financial flexibility to see the business ‘through the cycle’.

It’s quite revealing that out of 28 companies in the ASX 200 which have raised equity from shareholders (refer Table 1) via discounted, dilutive transactions totalling more than $17bn:

- 14% had actually undertaken share-buy backs in the last three years; and

- The median dividend payout ratio of those that raised was 70%.

Source: ASX Company Announcements (20 Feb 2020 – 27 Mar 2020), FactSet

In a world which is becoming increasingly volatile and unpredictable, a strong case can be made for more conservative settings. Over the last decade, Australian companies had the opportunity to binge on ‘cheap debt’ and ‘abundant liquidity’ and many did, successfully avoiding the ‘lazy balance sheet’ tag.

Post COVID-19, we can expect to see lower dividend payout ratios and lower gearing, in particular for volatile businesses.

Source: FactSet, May 2020

The medium term outlook for dividends is clearly challenged. The ASX yields 4.2% based on trailing 12-month dividends and 3.4% based on consensus forecasts for the next year. With dividend payout ratios likely to step down, we do not see a ‘V’ shaped recovery in dividends.

Source: FactSet, May 2020

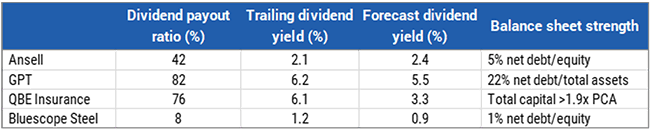

Through this period, we have been a buyer of a number of cyclical businesses with ‘through the cycle’ balance sheets, including Ansell, GPT, QBE and Bluescope Steel (see above). We see these companies as being well positioned to re-rate alongside the recovering global economy and, more importantly, withstand any future potential shocks.

0 Comments