Roy Keenan, Head of Australian Fixed Income and Portfolio Manager of the Yarra Enhanced Income Fund, details the backdrop to one of the Fund’s key securities.

The investment grade (IG) real estate sector is certainly one of the worst affected by the COVID-19 pandemic, with lower visitations across retail and office assets driving down income and valuations.

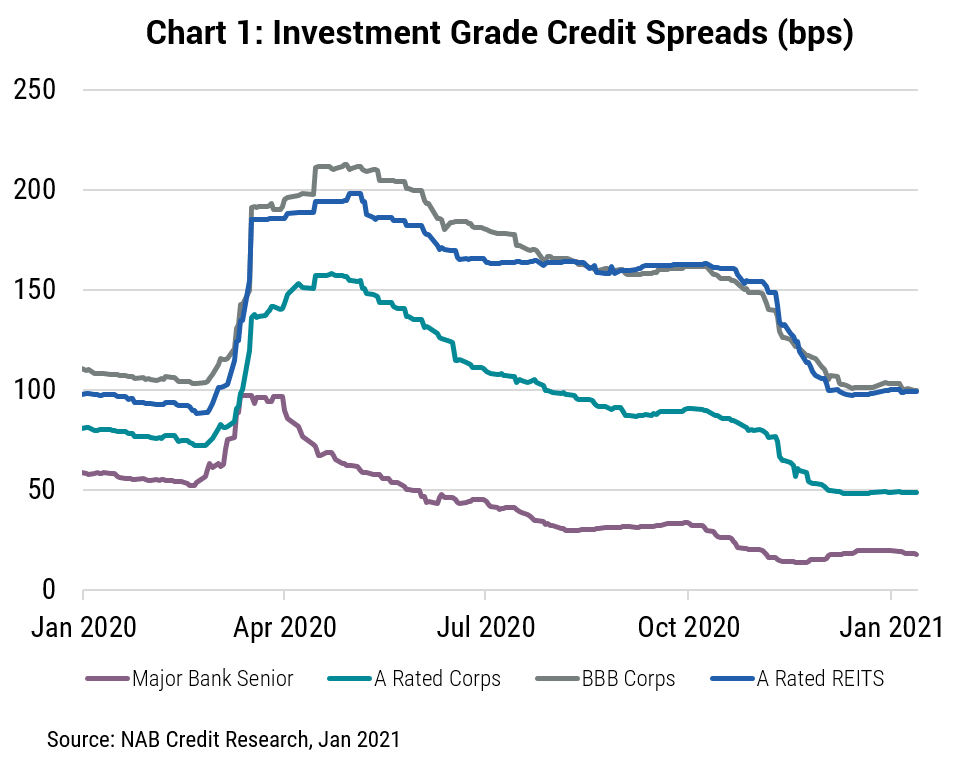

Looking at credit margins, which represent the major portion of interest payable to investors on new and existing bonds, REITs have significantly underperformed similar rated corporates and the major banks, now trading in line with riskier corporates (refer Chart 1).

A continued rebalancing in REIT valuations is expected as the property market establishes its ‘new’ normal, with online shopping and work from home increasingly popular and, unquestionably, here to stay in some form. These structural changes are negatively impacting creditworthiness, with REIT issuers now compelled to pay more on new debt than other bond issuers from less impacted sectors.

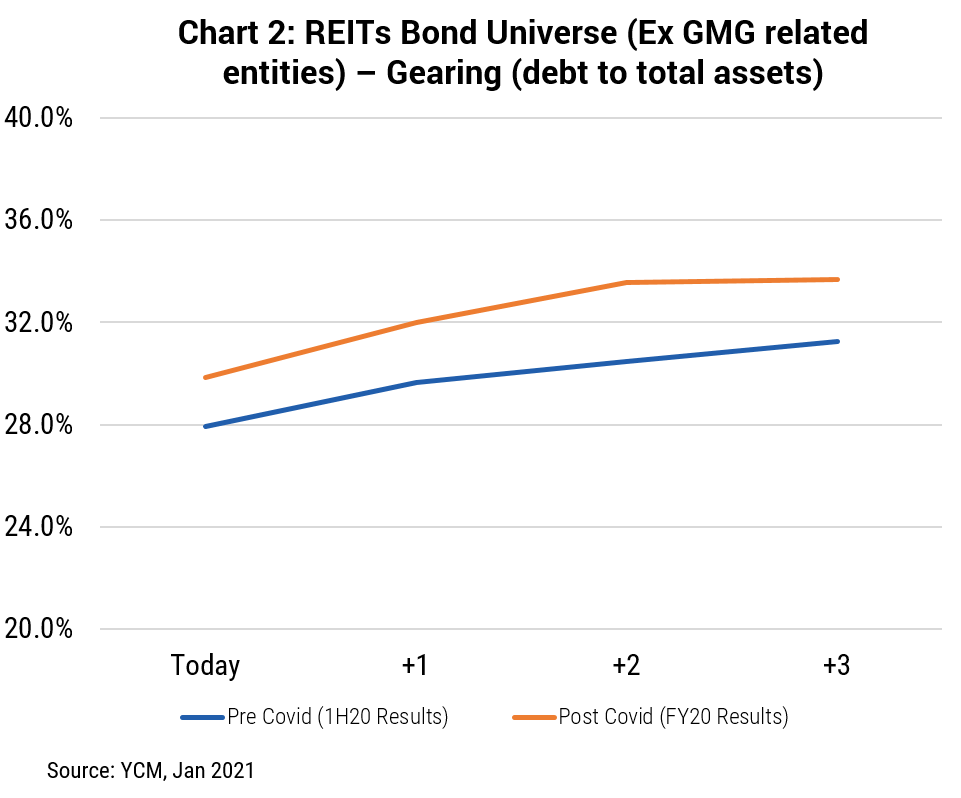

In our experience, however, investors often ignore the significant protection from impairments offered by most IG REITs. While our analysis suggests gearing will rise, many of the cohort have gearing at or below 30% (Chart 2), ensuring credit investors remain well protected since shareholders absorb first losses from income and property valuations. We anticipate a modest 5% increase in gearing out to 2023, which we expect will be comfortably absorbed without impacting creditors.

Within the real estate sector today, we currently favour the Lendlease managed Australian Prime Property Fund (APPF) 2024 securities. We purchased these bonds in this unlisted, prime Retail REIT in July last year at a ~300 bps credit margin, roughly three-times those in the pre-COVID market.

These bonds offer significant protections via high asset quality, low gearing (~30%) and, critically, a covenant which prohibits any increase in gearing above 35%. As we anticipated, the management team have proven themselves prudent managers of capital through the COVID period, reducing distributions and capital redemptions to maintain credit worthiness.

Since July 2020 these bonds have delivered strong performance for our Fund investors, with credit margins contracting by ~30 bps. We expect APPF to deliver further outperformance in 2021 as prime retail property transitions to its post-COVID environment.

The Yarra Enhanced Income Fund offers stable, regular income, and currently provides unitholders with a yield of 3.16%[1]. Since its inception in 2003, the Fund has established a long track record of achieving its performance objectives, significantly outperforming the RBA Cash Rate and delivering annual distributions (incl. franking) of 6.24% p.a. For further information on the Yarra Enhanced Income Fund, please click here or contact a member of the firm’s Distribution Team.

Roy Keenan

Portfolio Manager, Yarra Enhanced Income Fund

[1] Running yield as at 31 December 2020.

0 Comments