With reflation trade sentiment now mainstream, attention has turned to the impact that higher bond yields will have on risk assets and, more specifically, credit margins. Phil Strano, Portfolio Manager of the Yarra Absolute Credit Fund, takes a look.

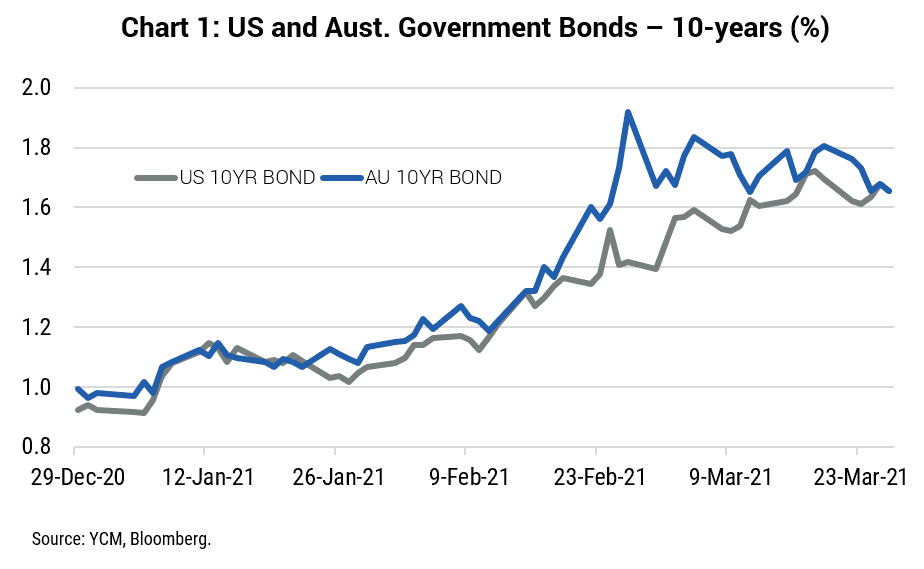

While EVERYTHING 2020-related was justifiably pandemic obsessed, we can now perhaps point to a new obsession for the reflation trade in 2021. Globally, more robust growth outlooks and higher inflationary expectations are pressuring long-end government bond yields, particularly in the US and here in Australia (refer Chart 1).

Overall, the combination of vaccine rollouts, very expansionary fiscal policy and high accumulated savings is delivering a strong rebound in economic growth, with Australia’s real GDP growth expected to rebound by 6% and 3.2% in the next two years respectively (refer Chart 2).

With reflation trade sentiment now mainstream, attention is turning to the impact that higher bond yields will have on risk assets and, more specifically, credit margins.

Based on more buoyant expectations for global growth, we see underlying credit conditions remaining broadly supportive, with increased economic activity mitigating modest increases in borrowing costs. Thus, most fixed income investors will likely remain invested in credit in 2021/22, taking advantage of higher outright yields and higher carry from credit.

In many ways we expect 2021/22 to be similar to 2005/06, where strong economic growth pushed credit margins lower and bond yields higher. For instance, in the US, in 2005/06 the more than 100 bps expansion in 10-year Treasury yields actually coincided with a 35 bps compression in triple B credit margins (refer Chart 3).

Reassuringly, the significant move higher in bond yields thus far in 2021 has had little impact on the Australian market with triple B credit margins only marginally off their February lows (refer Chart 4).

Moreover, excess demand for recent primary deals across the credit curve and asset classes (generally 3-4 times oversubscribed) confirms investor comfort with higher bond yields and the positive outlook for credit markets.

For instance, issued last month, the order books for ALE Direct Property Trust (BBB/Neg) and BWP Trust (A-/Stable) were both more than 4 times oversubscribed, with pricing guidance tightened significantly due to strong demand.

A year on from the onset of the pandemic, our average investment grade Absolute Credit Fund has achieved very strong returns, delivering net outperformance of ~730 bps for the 12 months to 31 March 2021. Looking ahead, we remain well placed to continue delivering consistent returns, with current yields on our credit portfolios ranging between 3.5-4.0% p.a.

0 Comments