While Australian Major Bank T1s are rightly held in high regard, their USD-issued equivalents now trade at a substantial premium and offer much higher risk-adjusted returns. Investors able to access Australian credit in offshore markets remain at a distinct advantage to those constrained to local shores.

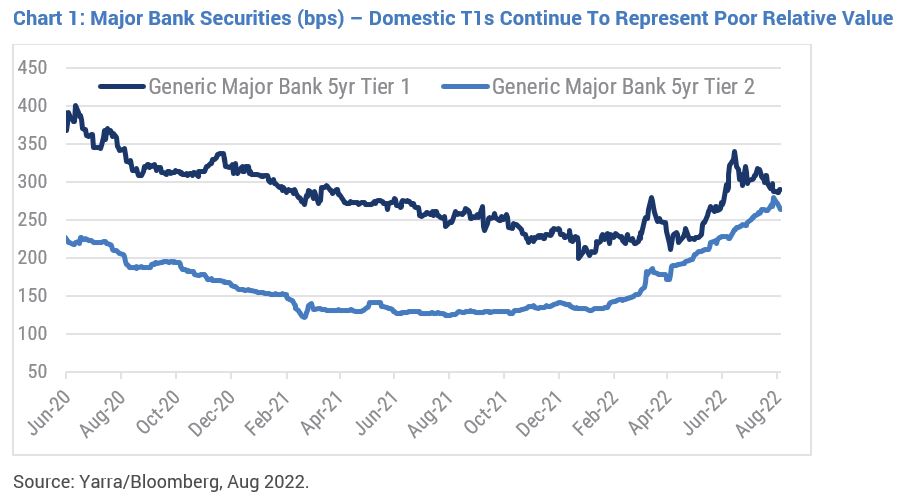

Our readers may recall a research piece we compiled in May where we highlighted just how expensive major bank BBB- rated Tier 1 (T1) hybrid securities were compared to the lower risk major bank BBB+ rated Tier 2s (T2). At the time, T1 credit margins were trading just ~40bps wider than T2 despite being two notches lower in credit quality. Incredibly, that gap has narrowed further to just ~20bps following the recent T2 issuance from NAB and ANZ which priced at very attractive margins of BBSW+280bps and BBSW+270bps respectively (refer Chart 1). Moreover, based on historical averages, T1s currently look incredibly expensive and should be trading ~200bps wider of current valuations.

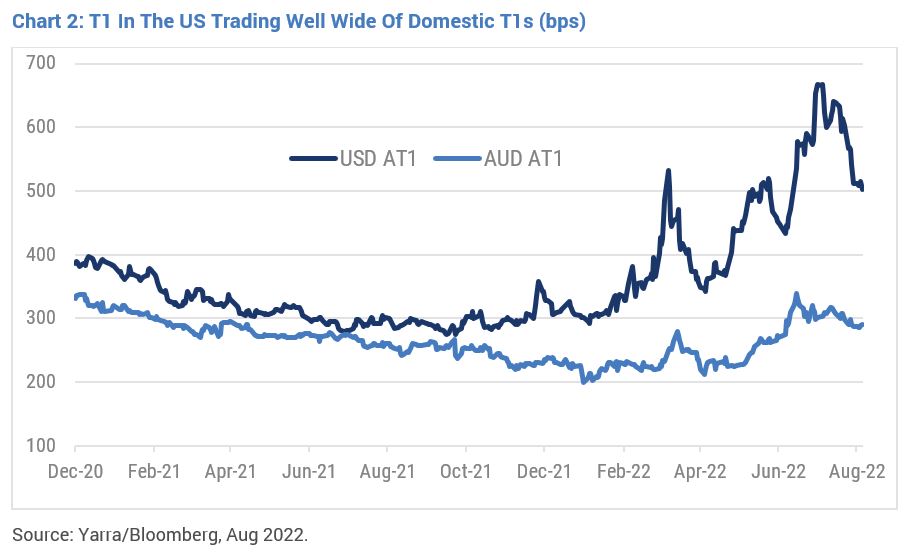

Interestingly, based on offshore T1 pricing, it seems this disconnect in bank hybrid capital pricing is more of an Australian phenomenon. After diverging in late 2021, there is now a dramatic gap between the two, with US T1s now trading ~200bps wider than their Australian comparatives (refer Chart 2).

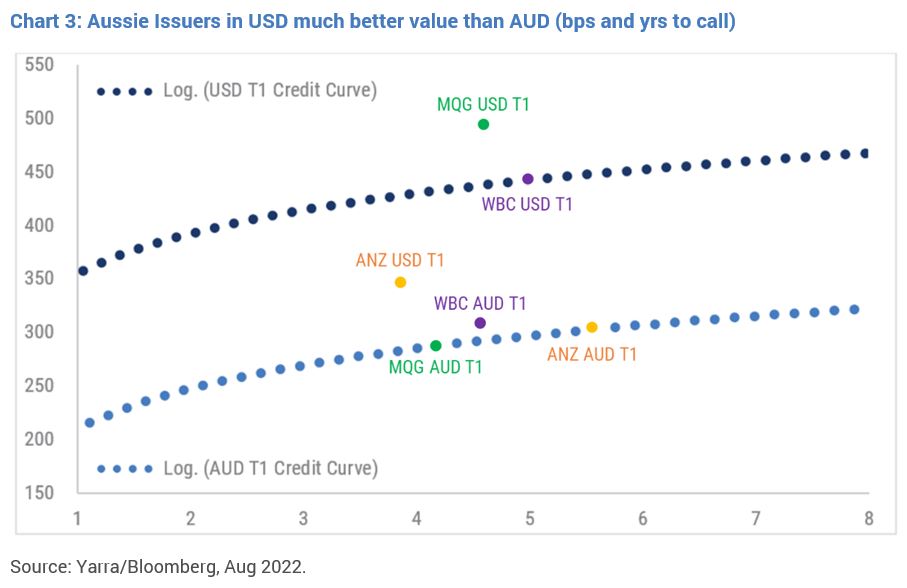

Looking at T1 curves in Chart 3 – the US (dark blue line) and Australia (light blue line), there are several opportunities for domestic investors to extract a significant premia by choosing the US dollar denominated Australian T1s and hedging out the currency and interest rate risk. We recently purchased a meaningful size of the 2027 Westpac USD T1s. The security swapped back to a credit margin of BBSW+480bps, ~200bps wider than the equivalent ASX-listed security, with all currency and interest rate risk hedged throughout the life of the security.

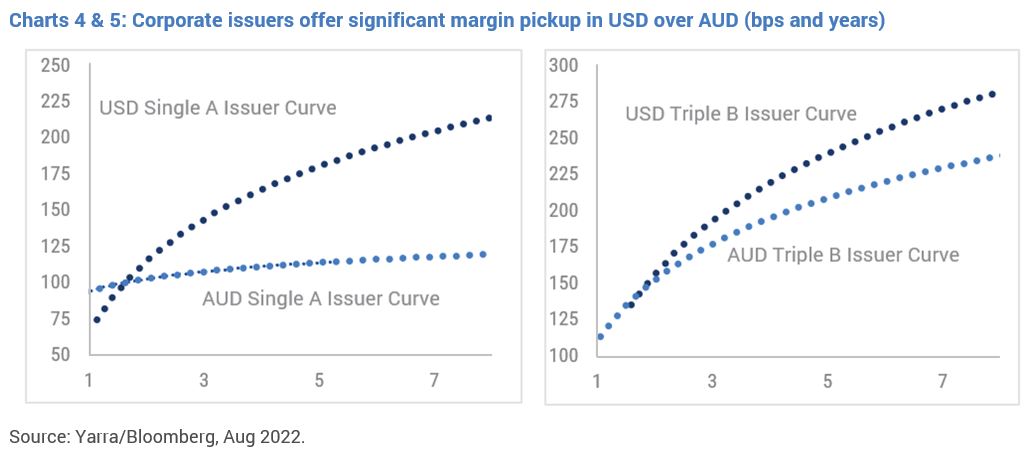

By comparison, given their more attractive pricing domesticly compared to T1, the same pick-ups in credit margins offshore are not currently available in bank senior or T2 segments. However, there are similar opportunities in Australian corporate credit with both the single A and triple B rated curves for Australian issuers significantly wider in USD than in AUD (refer Chart 4 and 5).

This approach is enabling us to harvest higher risk adjusted returns across most sectors of Australian credit, while maintaining diversity across the spectrum of household Australian names which are a mainstay of most equity portfolios but typically do not issue debt in AUD. This long list includes major corporates such as BHP, Rio Tinto, Brambles, Bluescope and CSL, to name only a few.

Where it makes sense to do so, the Yarra Higher Income Fund is investing in Australian issuers across major currencies; hedging out currency and interest rate risk to optimise risk adjusted returns. With a current yield at ~5% which we expect will increase alongside rising interest rates, the Fund remains well placed to continue delivering consistent monthly income to its investors.

0 Comments