With the RBA continuing to stoke market volatility as it ratchets interest rates higher, it seems APRA, Australia’s other financial regulator, is eager to get in on the action and generate some volatility of its own.

On Melbourne Cup Day, APRA published a letter from its new Chair John Lonsdale. In it, the financial regulator stated its desire for financial institutions to consider their optionality in existing AT1 and T2 hybrid capital securities and not refinance at their respective call dates on economic grounds due to credit spreads being significantly wider.

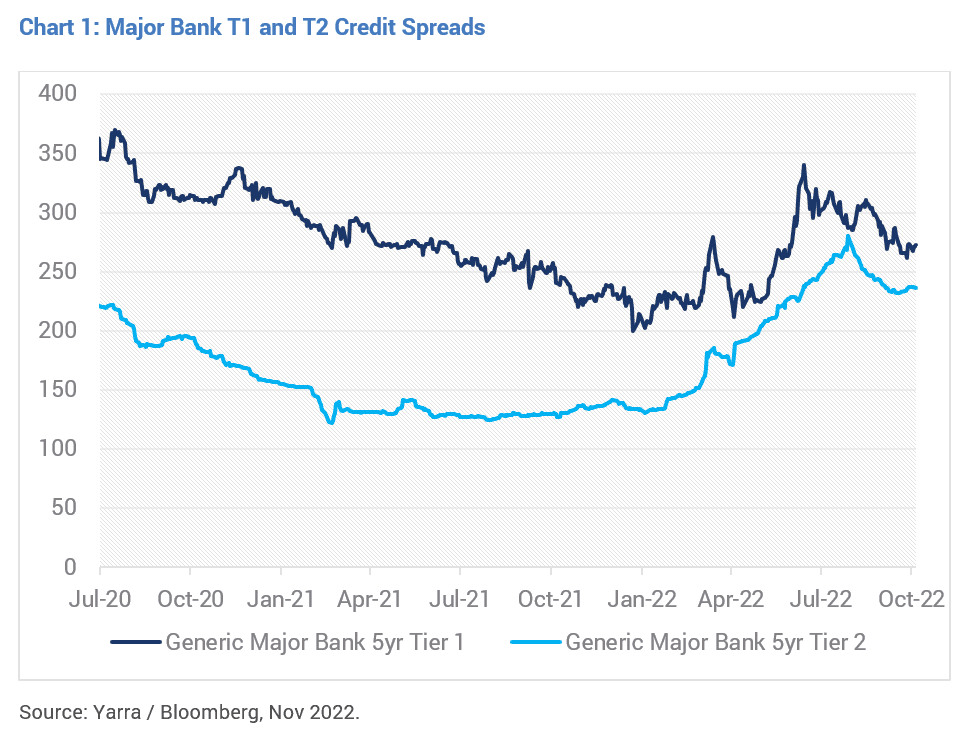

As expected, this statement generated significant volatility, with major bank T2 credit spreads out an additional ~20bps. Commonwealth Bank’s recently issued 10nc5 securities with a 2027 call date traded at ~BBSW+290bps in the days following, wide of its +270bps issue credit spread. By contrast, domestic AT1 credit spreads were little moved by APRAs announcement, continuing the disconnect between major bank AT1/T2 pricing which we’ve previously highlighted at length.

Let’s examine APRA’s suggestion more closely that financial institutions, in refinancing securities, are making ‘uneconomic calls’. It is noteworthy, as covered in previous notes, that domestic major AT1 credit spreads in the 250-300bps range are actually on the tighter side in absolute terms and remain very expensive relative to major bank T2s (refer Chart 1). So exercising call dates in T1 doesn’t seem to be ‘uneconomic’ at current levels.

Looking at major bank T2s, where credit spreads have indeed moved materially wider over the past 12 months, APRA is potentially in a bind of its own making. Having instructed the major banks in 2018 to comply with new total loss absorption capital (TLAC) provisions and raise, at the time, ~$60 billion of additional T2 capital (now ~$35 billion – refer Chart 2) by January 2026, it seems counter intuitive to effectively kneecap their funding efforts by instructing them not to refinance T2 securities at their call dates.

It’s not difficult to see how extending the term of these securities will make this task much more problematic and, ultimately, more costly. Not less so! Offshore and domestic T2 investors would rightly recoil at security extensions and would require greater compensation for heightened maturity extension risk. This would only increase funding costs on additional T2 required under TLAC.

If APRA follows through and compels major banks not to refinance T2 securities on call dates, we could reasonably expect longer-dated bullet T2 issuance – a feature in some offshore markets – to become a more prominent feature of domestic funding markets. Of course, T2 investors would naturally demand more compensation for longer maturities, ensuring a more expensive exercise for the major banks.

This compares to an existing understanding between market participants that T2 and AT1 calls are not exercised in the unlikely event of non-viability or severe market disruption, as occurred with the Challenger Group’s AT1s during the height of COVID in 2020. In this instance, Challenger did not call, but kept faith with investors by refinancing upon resumption of more normal funding conditions, rather than any call on economic or uneconomic credit spreads.

Post publication of APRA’s letter, two financial institutions – Challenger Group and AMP – have been permitted by APRA to exercise calls on existing T2s. Time will tell whether this is a blip or a continuation of pre-existing conventions. Ultimately, any measure of ‘uneconomic’ refinancings by APRA’s definition should take into account all of the factors discussed, which we’re sure major bank Treasury departments remain acutely aware of.

We hope that APRA doesn’t follow through and score an own goal negatively impacting funding markets, and instead ensures a continuation of a more nuanced approach to call dates and the preservation of well-functioning funding markets.

0 Comments