Roy Keenan, Co-Head of Fixed Income

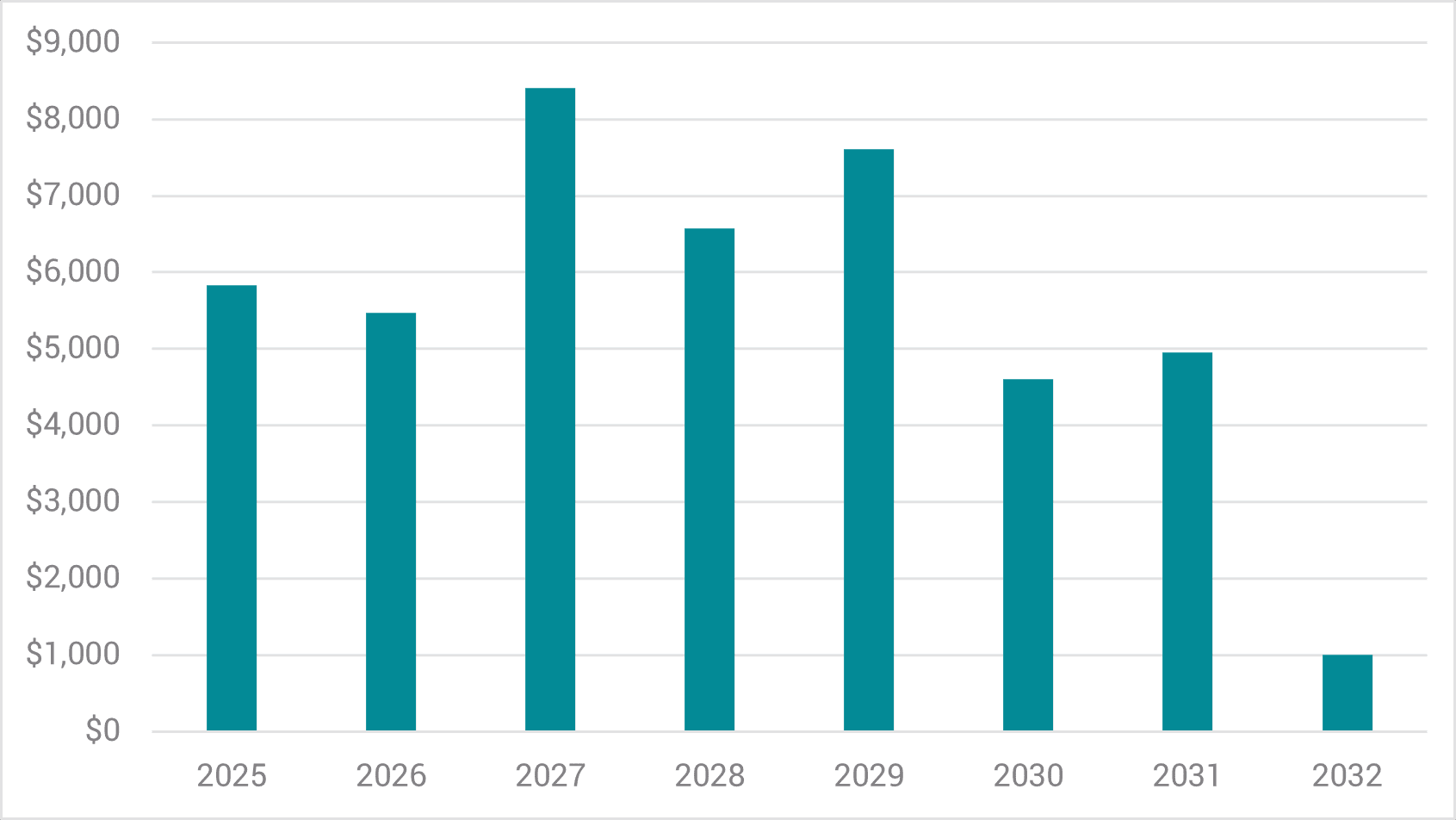

While APRA’s move has disappointed market participants, the planned transition of $44bn of AT1 hybrids to Tier 2 capital by 2032 is generally seen as being manageable (refer Chart 1).

Chart 1 – AT1 redemption profile to 2032 (A$bn)

Source: Bloomberg, YarraCM, January 2025.

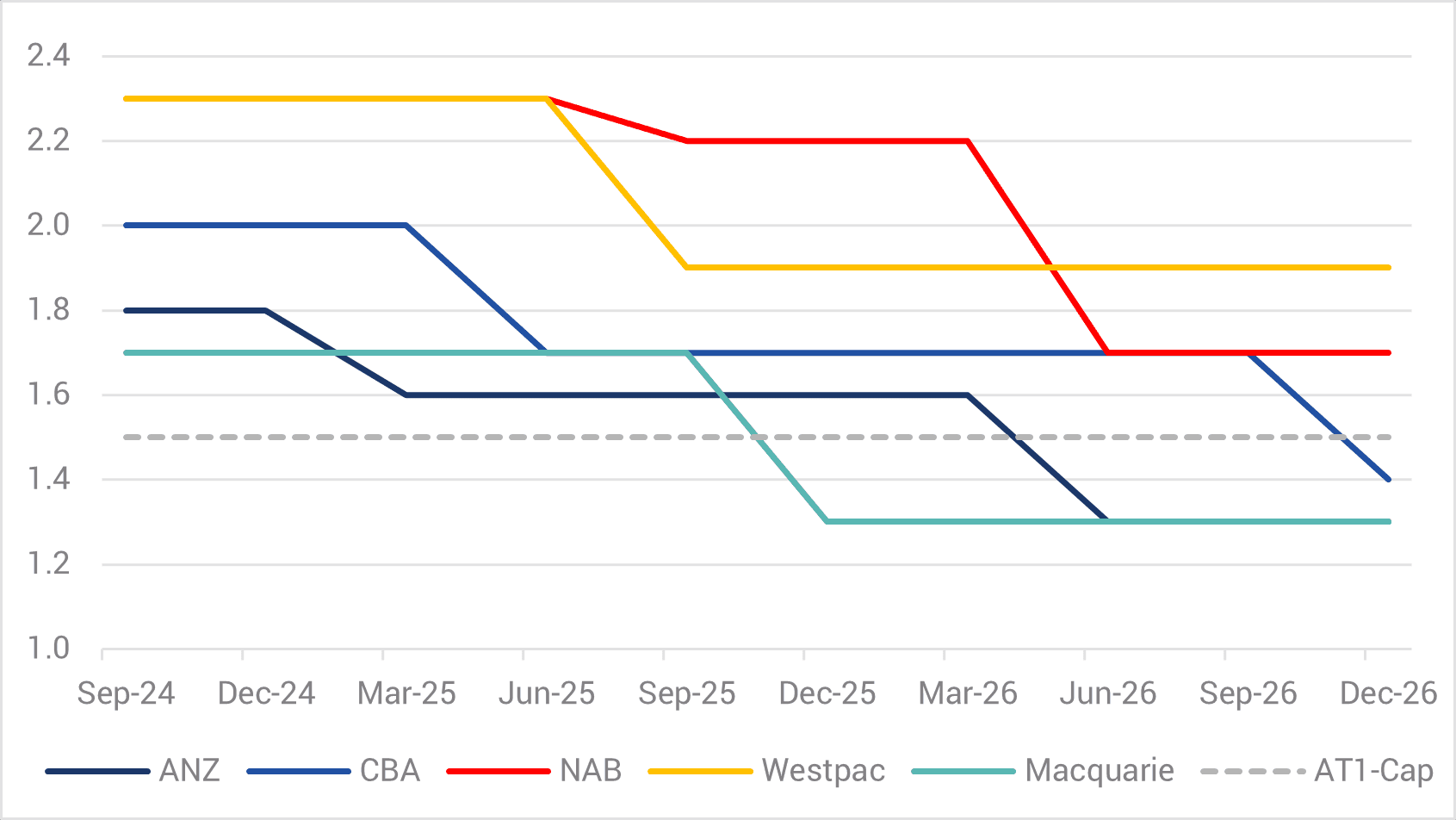

The implementation date for this planned change is 1 January 2027, raising the obvious question of what happens to AT1 hybrids with call dates in 2025 and 2026. Will APRA allow these securities to be rolled out to 2031/32? This question was answered in APRA’s letter dated 9 December 2024: Australian banks with surplus AT1 (>1.5% of Risk Weighted Assets) as of 1 January 2027 are expected not to issue new AT1 hybrids.

With this guidance in mind, what is likely to happen to AT1 securities with call dates in 2025/26?

As you can see in Chart 2, Westpac ($1.7bn) and NAB ($2.5bn) will not be permitted to roll their existing AT1 hybrids, since their AT1 issuance will be above the 1.5% cap. CBA ($2.5bn) will fall below 1.5% in October 2026, ANZ ($3.3bn) in June 2026 and Macquarie ($0.6bn) in December 2025. With CBA at 1.4%, ANZ and Macquarie at 1.3%, any potential deals from these banks will likely be small. Hence it is unlikely we will see any meaningful issuance in 2025/26 given ANZ, CBA and Macquarie have an estimated $1.4bn of AT1 capacity below the 1.5% limit. All banks will need to submit their plans to APRA by 31 March 2025, so we should soon know what the banks are planning to do.

Chart 2 – Major bank AT1 levels (% of risk-weighted assets)

Source: Westpac, YarraCM, January 2025.

With $11.3bn of AT1 hybrids up for call in 2025/26 and limited likelihood of any meaningful roll opportunities, investors need to start thinking about what to do with their current holdings in AT1 hybrids.

Under APRA’s proposal, from 1 January 2027 all existing AT1 hybrids will qualify as Tier 2 from a capital perspective. While this is fine from APRA’s viewpoint, these AT1 hybrids are issued under a PDS with capital triggers that still exist. The only real change to the structure of these securities is the confirmation by APRA that these securities will be called at their first call date. Hence this removes the mandatory conversion to equity if the AT1 hybrid is not called at their respective call dates. So, from a risk perspective these AT1 hybrids should trade wider than Tier 2: the big question is how much wider?!

Chart 3 shows the credit spread between ASX-listed AT1s and the closest Tier 2 security for that bank. The average spread between Tier 2 and AT1 is 59 bps. From our perspective, whenever the credit spread between Tier 2 and AT1 gets to 20-30 bps we are typically looking to trade out of those AT1s.

Chart 3 – Major banks AT1 spreads to Tier 2

Source: YarraCM, Bloomberg, January 2025.

From a risk perspective, switching out of AT1 hybrids into Tier 2 (or even Senior or Subordinated Corporate debt) makes much more sense when credit spreads are so narrow. From a risk/reward perspective, switching makes sense since investors then: (i) move up the capital structure, (ii) receive two notch upgrades in credit rating, (iii) improve their liquidity position, and (iv) improve the prospect for alpha generation.

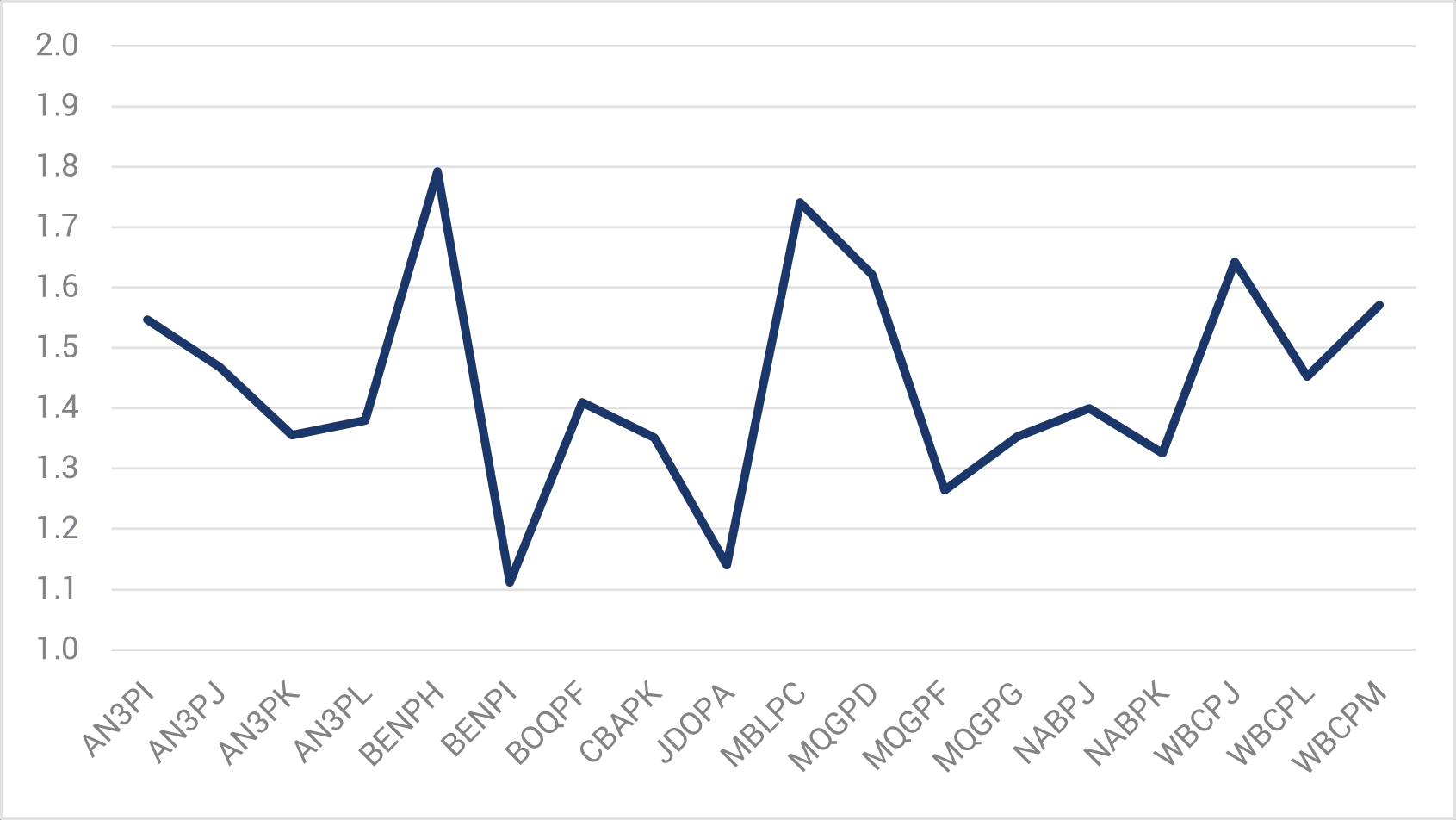

Historically speaking, the rule of thumb in moving from Tier 2 to AT1 hybrids is that you want to double the credit spread of Tier 2. Given APRA has informed banks that they must call their hybrids at the first call date, this ratio should be lower given the lower risk. Chart 4 shows the ratio between AT1 hybrids and Tier 2. While the ratio varies between issuer, the average ratio today is 1.44. If AT1s reach a ratio of 1.25-times this would also be a good exit level.

Chart 4 – Bank to AT1 to Tier 2 Ratio (x)

Source: YarraCM, Bloomberg, January 2025.

From our perspective, we don’t believe it makes sense for investors to adopt a passive approach with AT1 hybrids and simply hold them until they are called. These securities have not lost their risk characteristics and will continue to have them until they are called.

Clearly it’s a long time between now and March 2032 when the final AT1 hybrid will disappear. Our approach to the AT1 roll-down will be just like all segments of the credit market: investors should adopt an active approach and ensure they are getting paid for the risk they are taking. It is highly likely there will be times when we will be buyers of AT1 bank hybrids over the next seven years, just as we will be active sellers when they become too expensive.

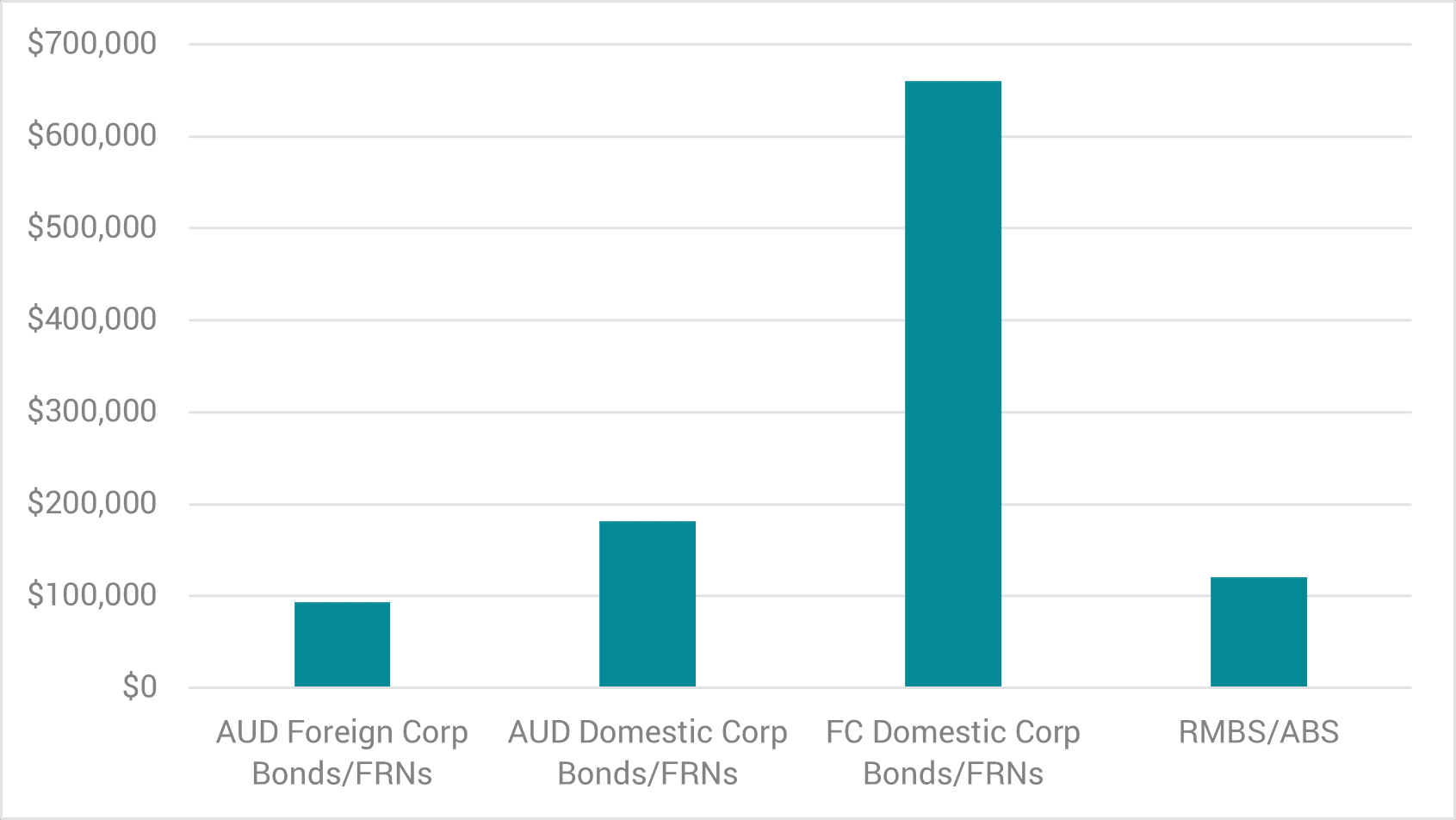

However, the ability for investors to redeploy maturities will soon significantly diminish, with AT1 outstandings now destined to start declining at a rate of ~$6.2bn p.a. from 2025 and the product effectively going extinct well before APRA’s 2032 cut-off. Therefore, it is now prudent for fixed income investors to examine Australia’s AT1 alternatives. In this regard, investors should be comforted by the plethora of diverse and high-quality Australian income products/securities at their disposal. As represented by the portfolios in our flagship credit funds (the Yarra Enhanced Income Fund (EIF) and Yarra Higher Income Fund (HIF)), the Australian credit market offers access to a large pool of income generating investments beyond just AT1s.

In fact, Australian credit outstandings and opportunities in the highly liquid OTC market dwarfs the ~$40bn in AT1s listed on the ASX. Cobbled together, Australia’s fixed income market (excluding government bonds) is ~$2 trillion in size and is roughly the same size as equity outstandings listed on the ASX. Even if you exclude the ~$1 trillion in corporate loans, most of which reside on bank balance sheets, there is ~$1 trillion in liquid traded credit alternatives to AT1s. This is an investment pool roughly 25 times greater than current AT1 outstandings.

Chart 5 – Australian Credit Market Outstandings ($mn)

Source: YarraCM, Bloomberg, RBA, January 2025.

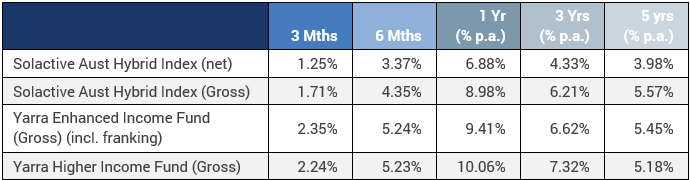

Moreover, the performance of both EIF and HIF is comparable to the grossed up Solactive Australian Hybrid (AT1s) Index return over 1, 3 and 5 years (refer Table 1). Credit quality is also very similar with both EIF and HIF’s portfolio credit quality remaining investment grade (BBB- and above) throughout this period; identical credit ratings to that of major bank AT1s (BBB-/BBB).

Table 1 – Performance – EIF/HIF v. Solactive Australian Hybrid Indices

Source: YarraCM, Bloomberg, RBA, January 2025.

Finally, going back further, EIF, which has a 22-year track record (established in 2002), has consistently outperformed the Solactive Index (refer Chart 6).

Chart 6 – Performance – EIF vs. Solactive Australian Hybrid Indices

Source: YarraCM, Bloomberg, January 2025.

Pushing bank AT1s into extinction well before APRA’s 2032 cut-off is of natural concern to many fixed income investors. Looking into 2025 and beyond, however, we still see significant opportunities for prudent investors to diversify their fixed income holdings beyond AT1s and earn comparable risk-adjusted returns. Our Enhanced Income Fund and Higher Income Fund are both well-placed to continue delivering outperformance for the period ahead.

0 Comments