Investing drills for Paris

By Will Low, Head of Global Equities, Nikko AM, Yarra Capital Management’s global partner.

The Tokyo 2020 Olympics showcased athletes at the top of their game, with one common theme being the commitment to training by all competitors. The Olympic time horizon of four years is more comparable to what we think of as an appropriate period when investing on behalf of our clients. Similarly, the equity markets reflect companies that are believed to be today’s winners in the race for profits. However, just as competitors will change by the next Olympics, a mixture of returning stars and a healthy number of new names will be found in the equity markets of the future.

Our job as stock pickers is to find these future winners, the medallists of Paris in equity form. To explain what I think is the best approach, I first wanted to highlight one Olympian, British shooter Seonaid McIntosh. She didn’t make the medal podium but continued a family tradition of target shooting. With her mother and sister both Commonwealth games medallists, and her father a successful shooter and coach, they clearly have something special as a family.

The reason I’m highlighting the McIntosh family is because I’ve done my own ~10,000 hours of target shooting with Seonaid’s parents across many successful competitions. Whilst my personal successes are dwarfed by the McIntosh clan, they were at a level to realise that having the right psychology is key to success in elite sporting competition. I learnt during that period that the best way to manage stressful competitions was to remain focused on just three key things and keep repeating them. Complete focus on these three drills worked much better than dwelling on the likelihood of winning or losing.

This rule of three can be equally applied to investing in the equity markets. The three key drills our team always follow when choosing Future Quality companies are:

1. High returns – Sustained high cash flow and returns on capital for growing companies should be targeted

Every company in which we invest has to have a strong franchise and management team that can deliver growth and sustain high returns on capital. Our long-standing holdings in Microsoft, TransUnion, and Progressive Corp are all examples that fit this criterion. Over the last decade our portfolios have consistently had a skew towards higher returns on capital, and superior revenue and earnings growth.

However, most companies are vulnerable to future competition, particularly when the returns on capital are high and/or the cost of capital is low. An analogy for the latter point in the current market is investors viewing opportunities as hot air balloons.

These balloons could be branded as technology disruption, electric vehicles, GameStop or other popular themes, but as time progresses these balloons will not stay high in the sky or travel very far unless they are refuelled by the arrival of profits. Our guess is that many will not see the latter scenario and the only debate will be the speed of their descent. Parts of the electric vehicle, internet, software and biotechnology sectors appear to be in the balloon category, primarily because they combine cheap capital (with the implications for future competition) and limited evidence of achieving high profitability over our required time horizon.

Which is why we are not in the business of investing in hot air balloons and prefer instead a grounded approach where we are confident of travelling for further and longer. Because of our insistence on having a clear path to achieving and then sustaining high returns on invested capital over the next five years, we may miss out on some of today’s high-flyers. But experience tells us that we may also avoid the significant drawdowns that are so detrimental to compounding capital over the long term.

2. Tail winds – Structural growth drivers can lead to several stock picks benefiting from a common theme

Every company we invest in must meet our Future Quality criteria on its own right, and the collection of these ideas shapes the overall portfolio. However, there are often themes that are common to several companies that we have identified as high conviction investments.

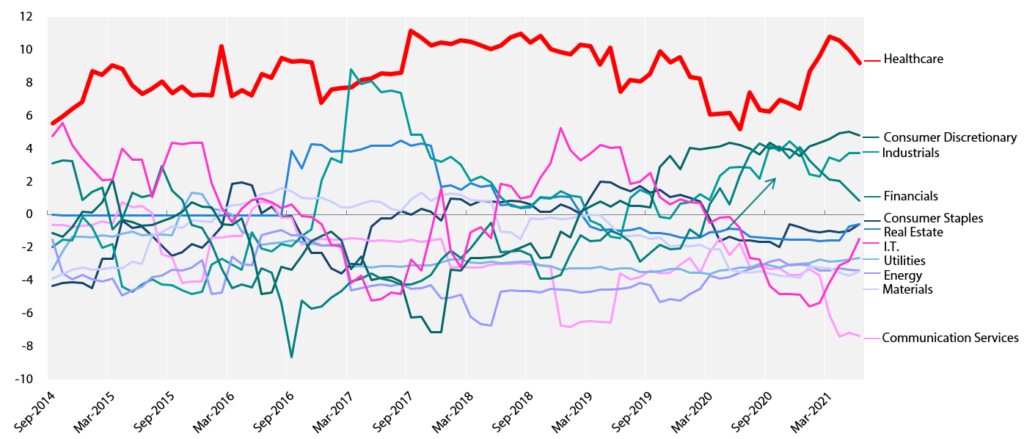

One theme that we believe is both enduring and underappreciated rests in the Healthcare sector. Specifically, companies that are able to deliver the cost-effective healthcare solutions that societies desire and need. This structural demand backdrop is a key element behind our high conviction in companies such as LHC, Encompass and Labcorp, and gene therapy businesses such as Bio-Techne and Danaher. These themes are a key element of why we have been notably overweight in the sector for much of the last decade.

Source: FactSet 1 September 2014–30 June 2021. Sector active weight uses Composite representative fund and benchmark MSCI ACWI ACWI-ex Australia Index from September 2014 to March 2016 and the MSCI ACWI Index from April 2016 to June 2021.

Recently we have identified the importance of energy transition, as societies increasingly realise that carbon emissions will have to be addressed more proactively. This may not be a new story, but its materiality from an investment perspective has become more significant due to: 1) greater anecdotal and scientific evidence of global warming, 2) higher energy and carbon pricing, 3) governments using green solutions as a mechanism for economic stimulus, and 4) asset owners favouring ESG solution providers and as a result lowering the cost of capital.

Hydrogen is an element with long-established technology that has been prematurely hyped in the past but, is now at a tipping point for demand acceleration as it is a component of reducing global CO2 emissions. Scale is key for the required cost reductions to make hydrogen more competitive, with the alternative being polluting energy sources. We are more confident that this is now being addressed due to more state sponsored projects, the ramping of capacity and most importantly the falling cost and availability of renewable energy that is key to green hydrogen.

3. Improvement – Individual journeys of improving returns on capital are key to idiosyncratic alpha

History tells us that most companies will not deliver very high returns on capital for prolonged periods. There is a low probability that companies can durably improve returns on capital from low or even average levels, to being amongst the best in class. However, when companies do go on such a journey, they are often fantastic investments, and that is why we seek improving returns on capital whenever possible.

Many holdings within the portfolio have these characteristics, but within the largest holdings there are a couple of companies that demonstrate that journey of improvement:

1. HelloFresh, a global leader in the meal-kit market with a track record of taking market share from peers. For example, five years ago HelloFresh only had a 20% share of the US market, but now the company’s share is close to 60% due to its improvements in product, price and service. With a data-driven approach, HelloFresh enjoys a superior business model compared to its e-commerce peers. The company also has higher order rates, demand predictability and free cash flow conversion. Through a vertically integrated supply chain and 90% of each box consisting of own-branded products, HelloFresh is able to capture a larger portion of the profit pool than traditional grocery retailers. This is driving sustained returns on invested capital above 20%, although the company had been loss making as recently as 2019.

2. Carlisle Companies, a leading supplier of innovative building envelope products and energy-efficient solutions. Its management team is in the process of refocusing the company’s capital allocation by selling non-core businesses to concentrate investments in their core roofing business (70% of sales). We believe that there is significant pent-up demand for their products, with commercial construction only now emerging from a long downturn. Re-roofing is also a source of increased energy efficiency and this should provide a more enduring tailwind for growth. Since our purchase over the last quarter the firm has announced the acquisition of Henry Company, a leading provider of building envelope systems, which further increases our confidence of driving returns higher through greater business focus.

0 Comments